HM Revenue & Customs (HMRC) is - in its own words - "the UK's tax, payments and customs authority".

To help fulfil its responsibilities, HMRC spent £10 billion with suppliers from January 2016 to the end of January 2022, and awarded - at least - £3 billion worth of contracts.

Using Tussell's market intelligence platform, this profile dissects HMRC's procurement behaviour over the past 6 years, covering its:

-

Spend

-

Contracts

-

Expiring Contracts

-

Suppliers

-

Frameworks

-

Sector Case-Studies (IT, Consulting & Facilities Management)

Scroll down to get a must-know view of this vital government department.

Find our other Procurement Profiles here:

-png.png)

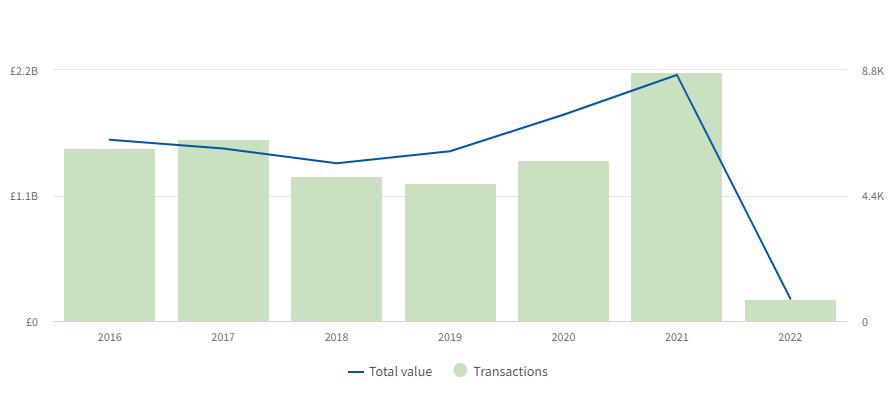

From January 2016 to the end of January 2022*, HMRC spent approximately £10.1 billion with suppliers across 37,551 transactions.

This made HMRC the 17th-largest public body by total spend with private organisations across this period: one place below Transport Scotland, and one place above the Welsh Government.

The above intelligence - produced within the Tussell platform - indicates that HMRC spending reached a peak of £2.2 billion in 2021, representing an average annual growth rate since 2016 of 6.6% - much higher than inflation until recently.

Across the covered period, HMRC's largest suppliers by spend were:

|

Supplier / Organisation |

Sector |

Total Invoice Value |

Average spend per year (2016-21) |

|

Capgemini UK PLC |

IT & Consulting |

£2.37bn |

£474m |

|

Fujitsu Services Ltd |

IT |

£1.42bn |

£284m |

|

Mapeley Steps Contractor Ltd |

Facilities Management |

£1.01bn |

£202m |

|

Revenue & Customs Digital Technology Services Ltd |

IT & Digital Transformation |

£639m |

£128m |

|

Accenture (UK) Ltd |

IT & Consulting |

£352m |

£70m |

* As of writing, this is the latest date HMRC has published its invoices.

From January 2016 to the end of January 2022, HMRC awarded at least 1,074 contracts at a total value of £3 billion.

The total value of contracts awarded by HMRC has gradually risen year-on-year since 2016, with 2021's total value sitting at just over £1 billion.

HMRC's largest contract awards across this period were:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

Dec 2020 |

£241m |

Fujitsu Services Ltd |

|

|

Dec 2021 |

£196m |

Worldpay Ltd |

|

|

Nov 2020 |

£169m |

Fujitsu Services Ltd |

|

|

May 2019 |

£105m |

Softcat PLC |

|

|

March 2021 |

£94m |

Amazon Web Services UK Ltd |

.png?width=680&name=Blog%20Banners%20(2).png)

.png?width=393&name=Untitled%20design%20(19).png)

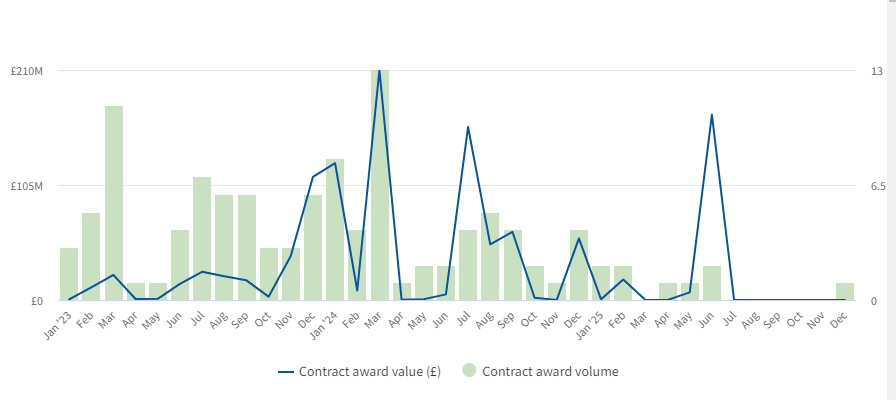

Tussell's platform identified 115 likely-to-be-renewed HMRC contracts - with a total value of £1.15 billion - that are due to expire between 2023 - 2025.*

The spike in upcoming renewal value in March 2024 comes from a number of expiring high-value contracts, namely three £28-29.5m HMRC Soft FM Services contracts covering Central, North and South, and a £94m HMRC_AWS006 Compute contract with Amazon Web Services UK Ltd for "'hyperscale' compute cloud and services provision".

Across this period, HMRC's largest upcoming potential renewals include:

|

Contract Title |

End Date |

Award Value |

Supplier(s) |

Award via Framework? |

|

June 2025 |

£169m |

Fujitsu Services Ltd |

No |

|

|

March 2024 |

£94m |

Amazon Web Services UK Ltd |

||

|

July 2024 |

£90m |

Cognizant Worldwide Ltd |

||

|

Jan 2024 |

£71m |

Wincanton Group Ltd |

No |

|

|

July 2024 |

£60m |

Cognizant Worldwide Ltd |

These are the opportunities where your BD teams should pre-engage with HMRC to make the case for why your firm has a better offering than the incumbent supplier. Upcoming renewals are gold-dust for sales pipeline-building.

* "likely-to-be-renewed" is defined as 'services' and 'supplies' contracts.

From January 2016 to the end of January 2022, HMRC awarded contracts to at least 455 suppliers.*

By total contract award value, HMRC's top suppliers across this period were:

|

Supplier |

Sector |

Total Award Value |

Largest Listed Contract |

Contract Value / Award Date |

|

Fujitsu Services Ltd |

IT |

£418m |

£241m / Dec 2020 |

|

|

Capgemini UK PLC |

IT & Consulting |

£226m |

£57m / Sept 2021 |

|

|

Worldpay Ltd |

Payment provider |

£196m |

£196m / Dec 2021 |

|

|

Equal Experts UK Ltd |

Technology consulting |

£193m |

£20m / June 2017 |

|

|

Cognizant Worldwide |

IT & Consulting |

£167m |

£90m / June 2021 |

The suppliers with whom HMRC has awarded contracts most frequently were:

-

Ipsos MORI UK Ltd (58 contract awards, valued at £4.06m)

-

I.F.F. Research Ltd (50 contract awards, valued at £4.85m)

-

Senator International Ltd (30 contract awards, valued at £21m)

-

Equal Experts UK Ltd (28 contract awards, valued at £193m)

-

Flexiform Business Furniture Ltd (27 contract awards, valued at £3.77m)

* This figure includes subsidiaries.

.png?width=680&name=4(8).png)

Ever wondered which frameworks HMRC uses to go to market?

Of the roughly 1,074 contracts awarded by HMRC from January 2016 to the end of January 2022, at least 493 - or 45% - were call-offs from a framework.

Using Tussell's framework analytics, we can see the total value of these call-offs sat at £1.65 billion, and spanned over 84 frameworks.

By value of total identified call-offs, HMRC's most valuable frameworks across the period were:

-

RM6118 - Payment Acceptance (£241m)

-

Technology Services 2 - RM3804 (£218m)

-

G-Cloud 12 (£147m)

By count of identified call-offs, HMRC's most utilised frameworks were:

-

G-Cloud 11 (56 call-offs)

-

G-Cloud 12 (48 call-offs)

-

RM6018 Research Marketplace Dynamic Purchasing System (39 call-offs)

-

Supply Delivery and Installation of Furniture and Associated Services - RM3812 (31 call-offs)

-

G-Cloud 10 (31 call-offs)

Across this period, HMRC operated approximately 11 frameworks of its own, with a maximum potential value of £28 million (the highest being Executive Search and Selection 2014 - HMRC Dynamic Purchasing System, at £10m).

.png?width=680&name=6(6).png)

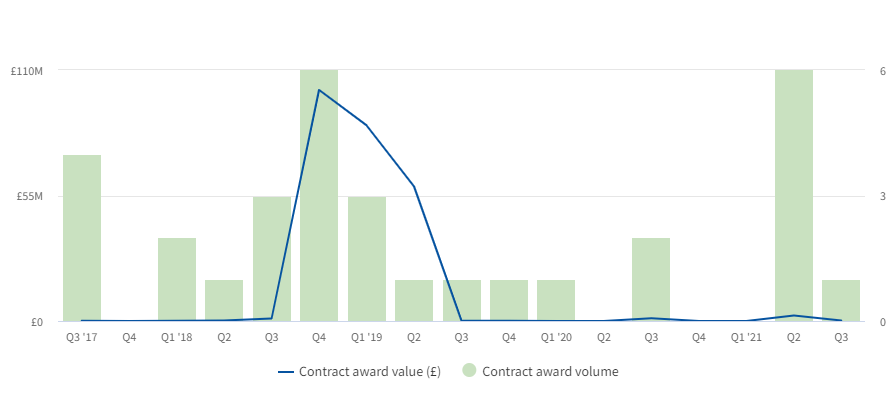

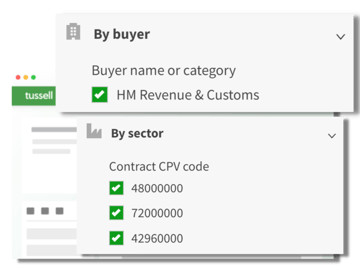

Below is a breakdown of HMRC's IT, consultancy and FM contract awards from January 2016 to the end of January 2022. This analysis was conducted using CPV codes and keyword searches, meaning the data may include some anomalous results.

IT and Software (CPV: 48000000, 72000000, 42960000)

From Jan 2016 - Jan 2022, HMRC awarded approximately 371 IT and software-related contracts, at a total value of £1.69 billion.

The above analysis indicates that both the volume and total value of HMRC IT and software contracts has increased year-on-year, reaching a peak of £684 million in 2021 (a 4229% increase from 2016).

The above analysis indicates that both the volume and total value of HMRC IT and software contracts has increased year-on-year, reaching a peak of £684 million in 2021 (a 4229% increase from 2016).

The largest suppliers in this sector - by total contract award value - includes Capgemini UK PLC (£197m), Equal Experts UK Ltd (£193m), Fujitsu Services Ltd (£177m), Cognizant Worldwide Ltd (£177m) and Amazon Web Services UK Ltd (£158m).

The largest contracts in this period include:

|

Contract Title |

Award Date |

Award Value |

Supplier(s) |

|

Nov 2020 |

£169m |

Fujitsu Services Ltd |

|

|

May 2019 |

£105m |

Softcat PLC |

|

|

March 2021 |

£94m |

Amazon Web Services UK Ltd |

|

|

June 2021 |

£90m |

Cognizant Worldwide Ltd |

|

|

Sept 2021 |

£85m |

Specialist Computer Centres PLC |

Marketing, Recruitment, Consultancy (CPV: 79000000)*

From 2016 - 2022, HMRC awarded approximately 198 consultancy-related contract awards, at a total value of £324 million. The above analysis shows that a substantial proportion of this total stems from a single contract in 2020, the £241m Trader Support Service - in part to "educate businesses on what the Northern Ireland protocol means for them", and provide a "free end-to-end support package to manage customs declarations" - to Fujitsu Services Ltd.

The above analysis shows that a substantial proportion of this total stems from a single contract in 2020, the £241m Trader Support Service - in part to "educate businesses on what the Northern Ireland protocol means for them", and provide a "free end-to-end support package to manage customs declarations" - to Fujitsu Services Ltd.

The largest suppliers in this sector - by total contract award value - include Fujitsu Services Ltd (£241m), Ernst & Young LLP (£11.2m), National Westminster Bank Public Ltd Company (£8m), OMD Group Ltd (£8m) and Deloitte LLP (£7.75m).

The largest consultancy-related contracts - excluding Trader Support Service - across this period included:

|

Contract Title |

Award Date |

Award Value |

Supplier(s) |

|

July 2020 |

£9m |

Ernst & Young LLP |

|

|

Nov 2018 |

£8m |

OMD Group Ltd |

|

|

July 2020 |

£8m |

National Westminster Bank Public Ltd Company |

|

|

Nov 2020 |

£7m |

Deloitte LLP |

|

|

March 2016 |

£4.5m |

Buyingteam Ltd |

* This search excluded the terms 'FM', 'Technology Services' and 'Desktop'

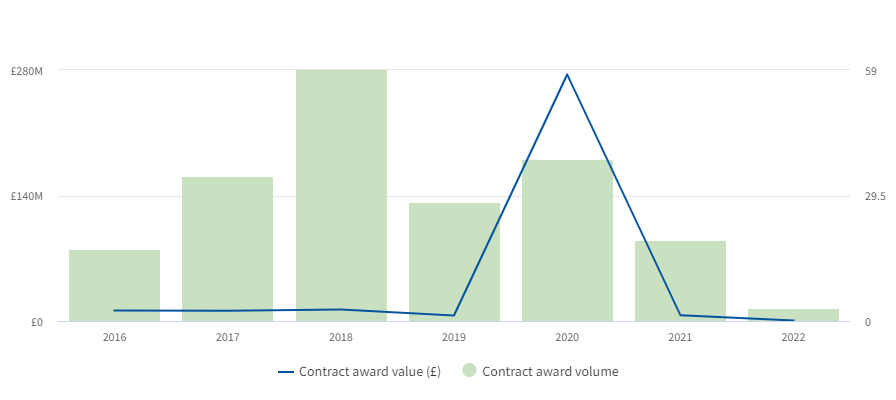

Facilities Management *

From Jan 2016 - Jan 2022, HMRC awarded approximately 32 FM-related contracts, at a total value of £252 million.

The spike in contract award value from Q4 2018 to Q2 2019 stems from a number of related high-value FM contract awards, namely 3 Hard FM contracts in Q4 2018 covering Central, Southern and Northern areas (valued from £41.3m to £28m), 3 equally segmented contracts for Soft FM contracts in Q1 2019 (valued from £29.5m to £28m), and a Security Services contract in Q2 2019.

The largest suppliers in this sector - by total contract award value - were SES Engineering Services Ltd (£69.3m), Mitie Security Ltd (£59m), Sodexo Ltd (£57.4m), Atalian Servest Group Ltd (£28.3m) and Bellrock Property & Facilities Management Ltd (£28m).

Excluding the aforementioned contracts, the largest contracts awarded in this period include:

|

Contract Title |

Award Date |

Award Value |

Supplier(s) |

|

Dec 2018 |

£4m |

Sitemark Ltd |

|

|

Aug 2020 |

£1.19m |

Castle Water Ltd |

|

|

Apr 2021 |

£912k |

Mapeley Steps Contractor Ltd |

|

|

Aug 2018 |

£850k |

Finyx Consulting Ltd |

|

|

Apr 2021 |

£520k |

Mapeley Steps Contractor Ltd |

* This search was conducted using a combination of several dozen keywords, such as "facilities management", "hard fm", "soft fm", "estate management" etc.

*

HMRC is spending more and more with suppliers to fulfill its complex responsibilities: with the right data and intelligence behind you, you can pin-point where your products and services fit into its procurement needs.

This profile only covers the surface of what Tussell's aggregated data platform can tell you about the public sector. With Tussell, you can analyse public spend, contract awards, favoured frameworks and more, helping you make more informed decisions and strategies when selling to the public sector.

Book a personalised demo with our team to see how Tussell can unlock public sector insights and opportunities for your business.

Find our other Procurement Profiles here:

%20v1.png)

.png?width=80&height=80&name=james%20v2%20(1).png)

-png.png?width=360&name=Untitled%20design%20(20)-png.png)

-png.png)

.png?width=370&name=Untitled%20design%20(18).png)

.png?width=680&name=3(7).png)

.png?width=377&name=Untitled%20design%20(22).png)

.png?width=377&name=Procurement%20Profile%20Product%20Screenshots%20(3).png)

.png?width=397&name=Procurement%20Profile%20Product%20Screenshots%20(1).png)

.png?width=391&name=Procurement%20Profile%20Product%20Screenshots%20(2).png)