The Department for Levelling Up, Housing and Communities (DLUHC) is responsible for - in its own words - "investing in local areas to drive growth and create jobs, delivering the homes our country needs, supporting our community and faith groups, and overseeing local government".

As part of its wide-reaching remit, the DLUHC has spent just over £1.8 billion with suppliers since 2016.

Getting your head around where this money is going is key if you want to start doing business with the DLUHC.

Using Tussell's market intelligence platform, this profile runs through the DLUHC's procurement footprint from 2016 to 2021,* including its:

-

Sector case-studies (IT & Consulting)

Find our other Procurement Profiles here.

* In this profile, data from the current DLUHC includes the contract awards and invoice data awards of its predecessor departments.

.png?width=680&name=1(15).png)

With Tussell's invoice-level spend data, we can see directly the transactions made between the DLUHC and suppliers, giving us a clear picture of its most valuable relationships.

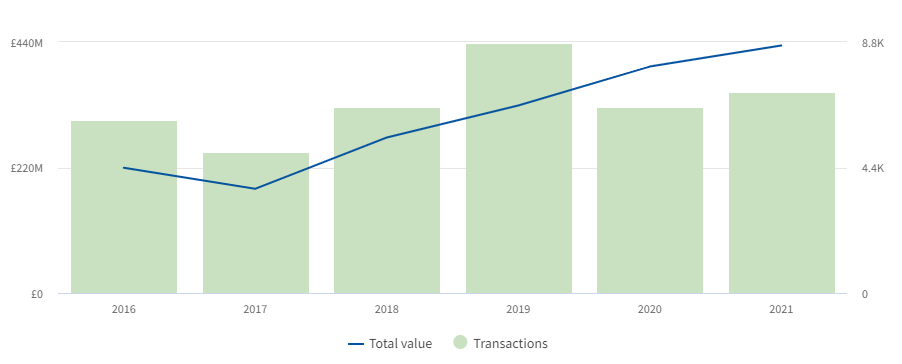

From January 2016 to December 2021, the DLUHC spent approximately £1.83 billion with suppliers, spanning nearly 40,000 individual transactions.

This made the DLUHC - by far - one of the smallest central government departments by spend.

The above analysis - produced via Tussell - shows that DLUHC spending has increased nearly 98% since 2016, rising year-on-year from £219.4 million in 2016 to £434 million in 2021.

Across this period, the DLUHC's largest suppliers by spend were:

|

Supplier / Organisation |

Sector |

Total Invoice Value |

Average spend per year (2016-21) |

|

Ebbsfleet Development Corporation |

Construction |

£198mn |

£39.6mn |

|

Improvement and Development Agency for Local Government |

Local Government |

£126mn |

£25.2mn |

|

Healthwatch Kingston Upon Thames |

Charity |

£109mn |

£21.8mn |

|

Age Concern Newcastle Upon Tyne |

Charity |

£87.7mn |

£29.2mn |

|

Amber Meef 2 LLP |

Infrastructure |

£51.2mn |

£17.1mn |

.png?width=680&name=2(14).png)

From 2016 - 2021, the DLUHC awarded at least 451 contract awards, at a total value of £405 million.

The above analysis shows a clear year-on-year growth in the volume of contracts awarded by the DLUHC since 2016. Their total value, however, has not followed as clear a trend, plateauing below £30mn between 2017 - 2019 at, before surging to £156mn in 2021.

Some of the DLUHC's largest contract awards over this period were:*

|

Title |

Award Date |

Award Value |

Supplier(s) |

Awarded via framework? |

|

Contract for the 2018-2922 Neighbourhood Planning Support Services - Contract Variation |

July 2021 |

£36.8mn |

Locality (UK) |

No |

|

July 2020 |

£26.3mn |

Locality (UK) |

No |

|

|

Sept 2016 |

£25mn |

Lendlease Construction (Europe) Ltd |

||

|

Sept 2016 |

£25mn |

Lendlease Construction (Europe) Ltd |

||

|

Mar 2016 |

£19.7mn |

National Centre for Social Research |

* This table excludes 2 variations of the Contract for the 2018-2022 Neighbourhood Planning Support Services contract, valued at £36.4mn and £33.6mn, both awarded to Locality (UK).

.png?width=680&name=6(9).png)

Anticipating upcoming opportunities well in advance is critical to success in public sector sales; building a pipeline of opportunities will allow you to pre-engage with the target contracting authority, and develop a more personalised bid.

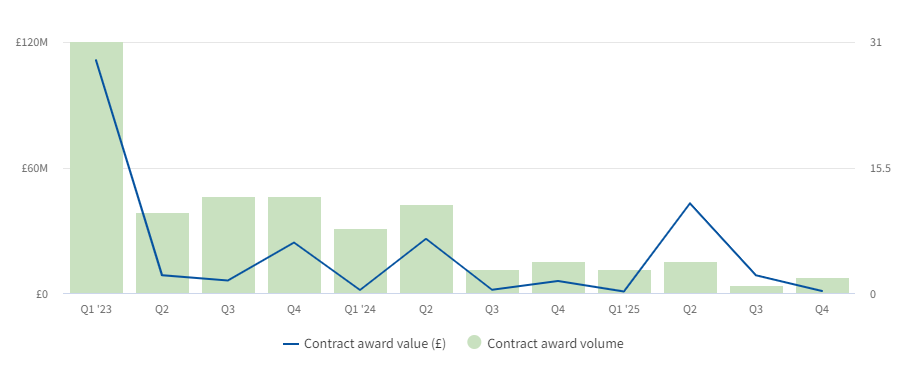

The Tussell platform identified 101 'likely-to-be-renew' contracts worth £238 million that are due to expire from 2023 - 2025.*

Some of the largest of these contracts include:

|

Title |

End Date |

Award Value |

Supplier(s) |

Award via Framework? |

|

Contract for the 2018-2022 Neighbourhood Planning Services - Contract Variation |

Mar 2023 |

£45mn |

Locality (UK) |

No |

|

Mar 2023 |

£19.7mn |

National Centre for Social Research |

||

|

Provision of Strategic Media Activation Services (Media Buying) |

May 2025 |

£18mn |

Manning Gottlieb OMD |

|

|

Apr 2025 |

£15mn |

Phoenix Software Ltd |

||

|

June 2025 |

£9.8mn |

Kantar UK Ltd |

* 'Likely-to-be-renewed' is defined as 'services' and 'supplies' contracts.

.png?width=680&name=3(13).png)

The Tussell platform allows you to quickly see who a contracting authorities' top suppliers are, both broadly and within specific sectors.

From 2016 - 2021, the DLUHC has awarded contracts to at least 235 suppliers.*

By total contract award value, the DLUHC's top suppliers across this period were:

|

Supplier |

Sector |

Total Award Value |

Largest Listed Contract |

Contract Value / Award Date |

|

Locality (UK) |

Civic and social organisations |

£136mn |

Contract for the 2018-2022 Neighbourhood Planning Support Services - Contract Variation |

£36.8mn / July 2021 |

|

Lendlease Construction (Europe) Ltd |

Construction |

£50mn |

£25mn / Sept 2016 |

|

|

National Centre for Social Research |

Research |

£31.8mn |

£19.7mn / Mar 2016 |

|

|

Ove Arup & Partners Ltd |

Engineering |

£12.4mn |

£10mn / June 2018 |

|

|

Deconstruct (UK) Ltd |

Construction |

£11.8mn |

£11.8mn / May 2021 |

The suppliers with whom the DLUHC awarded contracts to most frequently were:

-

Bytes Software Services Ltd (16 contract awards, worth £792k)

-

Made Tech Ltd (11 contract awards, worth £6.68mn)

-

SAP (UK) Ltd (9 contract awards, £3mn)

-

Tpximpact Ltd (8 contract awards, £5.3mn)

-

I.F.F Research Ltd (7 contract awards, £1mn)

* This figure includes subsidiaries.

.png?width=680&name=4(15).png)

A key route-to-market into the public sector is getting onto the framework agreements your target accounts are using to award new work: the key is knowing which frameworks are actually in use. Tussell's framework data coverage allows us to quickly find this out.

Of the roughly 464 contracts awarded by the DLUHC from 2016 - 2021, Tussell has identified at least 284 - or 61% - as being call-offs from a framework. This heavy usage shows how key frameworks are as a route-to-market for doing business with the DLUHC.

These call-offs sat a total value of £181 million, and spanned 44 different frameworks.

By the value of total identified call-offs, the DLUHC's most valuable frameworks across this period were:

-

ESN - Acquire, Design and Build Infrastructure Framework (£50mn)

-

RM6018 Research Marketplace DPS (£13.6mn)

-

RM6068 Technology Products and Associated Services (£9.88mn)

By volume of total identified call-offs, the DLUHC's most utilised frameworks across the period were:

-

RM6018 Research Marketplace DPS (54 call-offs)

-

G-Cloud 11 (39 call-offs)

-

G-Cloud 10 (21 call-offs)

-

G-Cloud 12 (20 call-offs)

Across this period, the DLUHC operated 11 of its own frameworks, with a maximum potential value of £203 million. This implies that the DLUHC prefers calling-off contracts from other authorities frameworks, rather than creating and using its own.

.png?width=680&name=5(11).png)

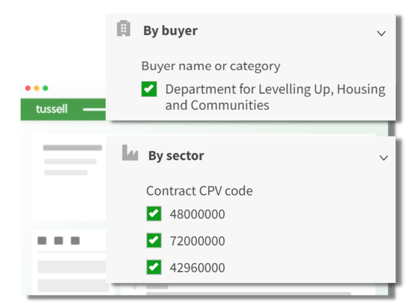

Below is a breakdown of the DLUHC's IT and consultancy-related contract awards from 2016 to 2021. This analysis was conducted using CPV codes and keywords searches, meaning the data may include some anomalous results.

IT & Software (CPV: 48000000, 72000000, 42960000)

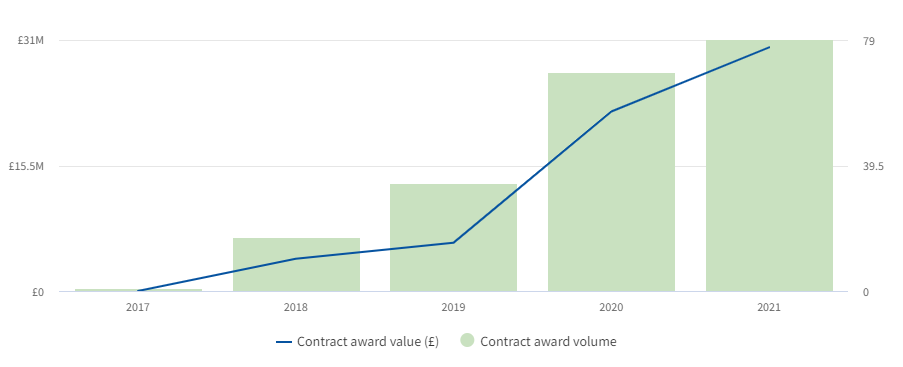

From 2016 to 2021, the DLUHC awarded approximately 200 IT-related contract awards, at a total value of £62.2 million.

The above analysis shows a very clear upward trajectory - both in volume and value - of IT goods and services being procured by the DLUHC since 2017, reaching a peak of £30mn in 2021.

The DLUHC's top IT suppliers - by total contract award value - were Phoenic Software Ltd (£9mn), Made Tech Ltd (£6.7mn), Evoco Digital Services Ltd (£5.7mn), Tpximpact Ltd (£5.3mn) and Arcus Global Ltd (£4.9mn).

The largest IT-related contracts awarded over this time were:

|

Contract title |

Award value |

Award date |

Supplier(s) |

|

MHCLG Microsoft Enterprise Agreement and Associated Services |

£9mn |

Nov 2020 |

Phoenix Software Ltd |

|

MHCLG Funding Service Design - Technical Development and Support |

£5.4mn |

Nov 2021 |

Evoco Digital Services Ltd |

|

£4.4mn |

Jan 2020 |

Arcus Global Ltd |

|

|

£3.7mn |

Oct 2021 |

Tpximpact Ltd |

|

|

£2.3mn |

Sept 2018 |

XMA Ltd |

Consultancy, Recruitment & Marketing (CPV: 79000000) *

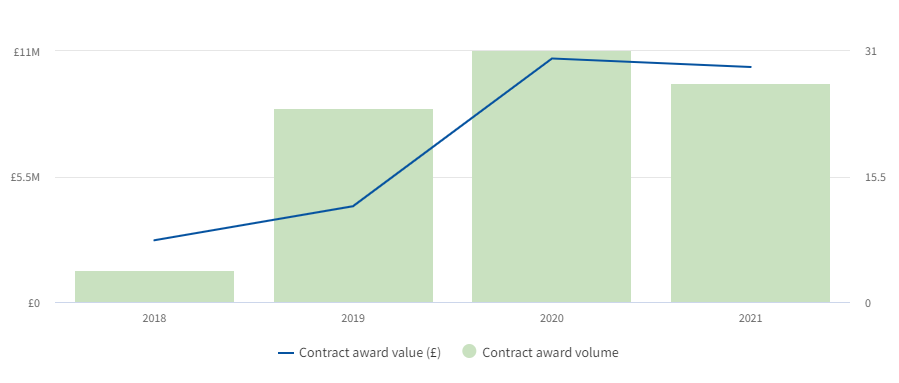

From 2016 to 2021, the DLUHC awarded around 86 consultancy-related contracts awards, at a total value of £28 million.

Our data indicates that the DLUHC's awarded the most of such contracts in 2020, at 31 contracts with a total value of £10.7mn.

The DLUHC's top consultancy-related suppliers across this period - by total contract award value - were Manning Gottlieb OMD (£4mn), Slaughter and May Ltd (£3.9mn), Bryan Cave Leighton Paisner LLP (£2mn), Faithful+Gould Ltd (£2mn) and PWC LLP (£2mn).

|

Contract title |

Award date |

Award value |

Supplier(s) |

|

Apr 2021 |

£3.9mn |

Slaughter and May Ltd |

|

|

Nov 2018 |

£2mn |

Manning Gottlieb OMD |

|

|

Apr 2021 |

£2mn |

Manning Gottlieb OMD |

|

|

Oct 2020 |

£1.9mn |

Faithful+Gould Ltd |

|

|

MHCLG - Statistical and Economic Analysis services - Contract |

Jan 2020 |

£1.8mn |

Deloitte LLP |

* This search excluded contracts containing the keywords 'software', 'IT' and 'ESN'.

*

The Department for Levelling Up, Housing and Communities may not have the largest procurement footprint compared with other central government departments, but it still offers millions of pounds worth of opportunities for suppliers of all sizes.

This profile only covers the surface of what Tussell's aggregated data platform can tell you about the public sector. With Tussell, you can analyse spend, contract awards, favoured frameworks and more, helping you make more informed decisions and strategies when selling to the public sector.

Book a personalised demo with our team to see how Tussell can unlock public sector insights and opportunities for your business.

%20v1.png)

.png?width=80&height=80&name=james%20v2%20(1).png)