The UK's Department for Business, Energy and Industrial Strategy (BEIS) is responsible for - as the National Audit Office puts it - maximising investment, promoting competitive markets, cultivating industrial activity and delivering green, affordable energy.

BEIS was formed in July 2016 and has since spent over £26 billion with private suppliers, making it the second-largest public sector buyer since its inception.

Understanding how, from whom and what BEIS procures is pivotal if you're looking to do business with them, or want to cement your existing relationships!

Using Tussell's aggregated data platform, this blog provides an analysis of BEIS's procurement behaviour from 2016 - 2020. Skip ahead to read about BEIS's:

Find our other Buyer Profiles here:

- Department for Work and Pensions

- Department of Health and Social Care

- Ministry of Justice

- Ministry of Defence

- Home Office

- Department for Transport

Tussell's database shows that since its creation to the end of 2020, BEIS spent approximately £26.2 billion across over 50,000 transactions with suppliers and organisations.

.png?width=680&name=82508bc1b4ecb5e66a80d13890276a7a%20(1).png)

This made BEIS the 2nd largest public sector buyer by total invoice value with private suppliers (when including non-profit organisations like research institutes, charities, societies, councils etc.). This was one place below the Ministry of Defence, and one above Network Rail Infrastructure.

From July 2016 - 2020 - excluding organisations like research institutes, charities, societies, councils etc. - BEIS's largest suppliers by spend were:

|

Supplier / Organisation |

Sector |

Total Invoice Value |

Largest Listed Contract |

Contract Value / Award Date |

|

ICF Consulting Services Ltd |

Strategy Consulting |

£57.5m |

£88.3m / Sept 2020 |

|

|

Triple Point Investment Management LLP |

Investment Management |

£44.3m |

$10.8m / July 2018 |

|

|

Bouygues E&S FM UK Ltd |

Construction |

£38.2m |

None publically listed. |

- |

|

Visionist Ltd |

Digital Consulting |

£35.1m |

£3.71m / March 2019 |

|

|

MW High Tech Projects UK Ltd |

Engineering |

£30.1m |

None publically listed. |

- |

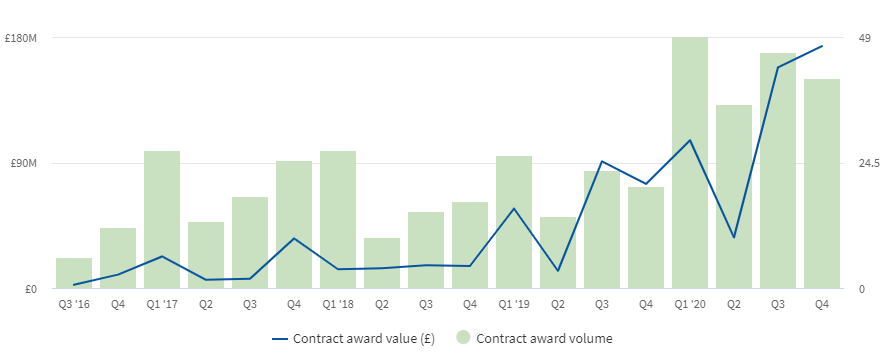

From 2016 - 2020, BEIS awarded - at least - 425 contracts across 325 suppliers, valued at £851 million.

As the above analysis shows, both the quantity and value of BEIS's contract awards has grown sizeable since 2019. The final half of 2020 saw BEIS's highest ever contract award totals, while the first quarter witnessed its highest volume of awarded contracts. Opportunities to do business with BEIS are growing year on year!

Over this period, its largest contracts included:*

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

September 2020 |

£88.3m |

ICF Consulting Services |

|

|

November 2020 |

£71m |

The Gavi Alliance |

|

|

UK PACT (United Kingdom Partnering for Accelerated Climate Transitions) |

January 2020 |

£60m |

PA Consulting Services, ICF Consulting Services, Palladium International |

|

July 2020 |

£50m |

C P Pharmaceuticals |

* BEIS's COVID-19 vaccine contract awards were assigned a designated nominal value of £1, so do not appear amongst the highest value contracts.

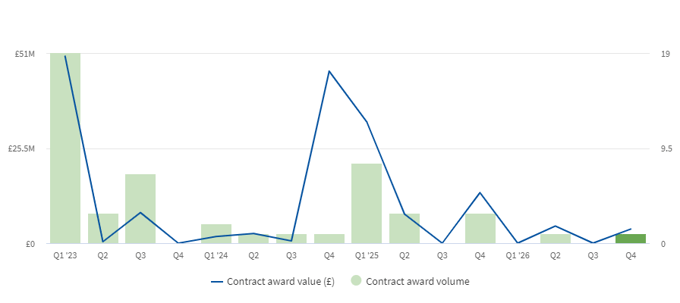

Tussell's platform identified 50 BEIS likely-to-be-renewed contracts *- with a total award value of £172 million - that are due to expire between 2023 and the end of 2026.

By scanning ahead, your business can engage early with BEIS to understand what exactly it is they are looking for on a bid.

Notably, only 5 of these contracts - valued at just over £31 million - were call-offs from a framework. Upcoming opportunities appear to lie predominantly outside frameworks, making BEIS a valuable target for companies not currently on many or any frameworks.

The largest of these contracts - that were not call-offs - are:

|

Contract Title |

End Date |

Award Value |

Supplier(s) |

|

October 2023 |

£71m |

The Gavi Alliance |

|

|

October 2024 |

£46.1m |

Hvivo Services Limited |

|

|

UK-London: Heat Networks Investment Project - Main Scheme Delivery Partner |

March 2023 |

£10.8m |

Triple Point LLP |

|

March 2025 |

£9.75m |

National Nuclear Laboratory Ltd |

|

|

Compilation and reporting of the National Atmospheric Emissions Inventory |

March 2025 |

£9.04m |

Ricardo-Aae Ltd, Aether Ltd, RSK Adas Ltd, GL Industrial Services UK Ltd, Forest Research Agency, Forestry Commission England, Gluckman Consulting Ltd, Rothamsted Research Ltd |

* "likely-to-be-renewed" = 'services' and 'supplies' contracts.

From 2016 - 2020, BEIS awarded contracts to over 300 suppliers.

This is an already large and diverse pool of suppliers of a relatively young department, and is a promising indicator if you're a hopeful BEIS supplier!

BEIS' largest suppliers - by total contract award value, and including only for-profit organisations - were:

|

Supplier |

Sector |

Total Contract Award Value |

Largest Listed Contract |

Contract Value / Award Date |

|

ICF Consulting Services |

Strategy Consulting |

£113m |

£88.3m / September 2020 |

|

|

C P Pharmaceuticals Ltd |

Pharmaceuticals |

£50m |

£50m / July 2020 |

|

|

Hvivo Services Ltd |

Biological Research |

£46.1m |

£46.1m / October 2020 |

|

|

PA Consulting Services |

Technology Consulting |

£27.7m |

UK PACT (United Kingdom Partnering for Accelerated Climate Transitions) |

~ £20m / January 2020 |

|

PWC |

Consulting |

£24.2m |

£9m / November 2020 |

Below is a breakdown of BEIS' spend on IT and Consultancy. This analysis was conducted using CPV codes, meaning the data collected may include some anomalous results.

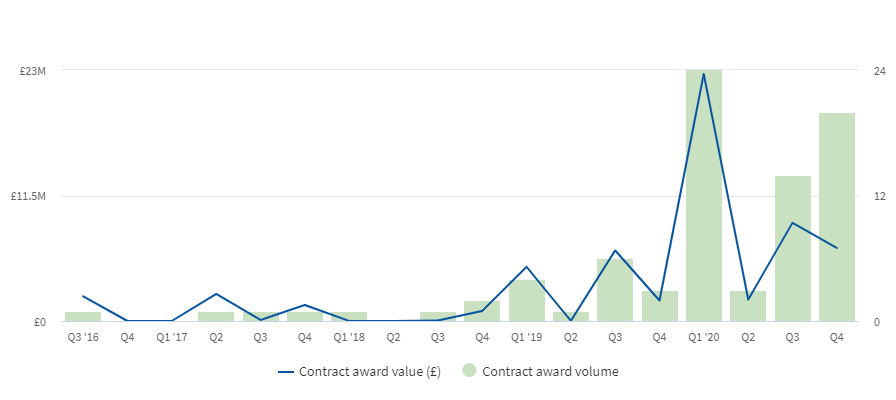

IT and Software (CPV: 48000000, 72000000, 42960000)

BEIS spent just over £60 million on IT and software-related contracts from 2016 - 2020, spanning 83 contracts and 64 suppliers.

As the above graph illustrates, the quantity of IT and software contracts - both in volume and value - have increased over the last couple of years.

The largest suppliers - by total contract award value - were Visionist (£9.61m), UniSystems SA (£6m), Trasys International (£6m), and UMI Commercial (£3.68m).

The largest contracts in this period included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

July 2019 |

£4.6m |

UniSystems SA, Trasys International |

|

|

UK Emissions Permitting, Monitoring, Reporting and Verification System |

January 2020 |

£3.78m |

UniSystems SA, Trasys International |

|

January 2020 |

£3.71m |

Visionist |

Looking ahead at BEIS' recently closed / still open IT-related contract notices and Pre-Information Notices (PINs) indicates its current and upcoming priorities:

-

Closing in November 2021, BEIS are looking for a digital partner to aid the recently founded Investment Security Unit, providing them access to "detailed information about ongoing UK-inbound foreign investment", and an "ability to conduct detailed due diligence" "at pace". The notice is valued at over £7 million.

-

In June 2021, BEIS closed a contract notice that sought to develop an Alpha build of an upcoming "enriched, machine-readable dataset of regulations and open API" across 2-3 business sectors. The notice was valued at nearly £700k.

-

In September 2021, BEIS closed a contract notice that sought to develop an Alpha build of an upcoming "digital service that enables building owners, tenants and assessors" to easily upload and compare their building's energy rating. The notice was valued at nearly £700k.

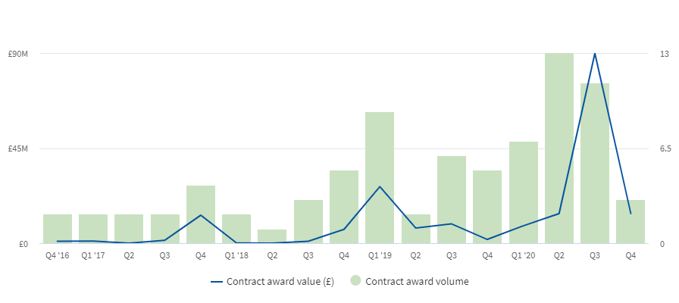

Marketing, Recruitment, Consultancy (CPV: 79000000)

BEIS spent approximately £195 million on marketing, recruitment and consultancy related contracts from 2016 - 2020, spanning 79 contract awards and 68 suppliers.

The largest suppliers were ICF Consulting Services (£88.3m), PWC (£15.8m) and Linklaters (£10m).

The largest contracts in this period included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

September 2020 |

£88.3m |

ICF Consulting |

|

|

November 2017 |

£10m |

Linklaters |

|

|

November 2020 |

£9m |

PWC |

Again, looking at BEIS' recently closed / open contract notices and PINs indicates the department's current and upcoming priorities:

-

In September 2021, BEIS published a PIN for a "contractor to support BEIS in the design of the trial phase of the Alternative Energy Markets (AEM) Programme", to change ways "consumers are charged for energy".

-

In September 2021, BEIS published a PIN for a "contractor to carry out a research programme which will answer overarching questions surrounding land mitigation options including bioenergy".

-

In December 2020, BEIS published a £1.7m PIN indicating a need for a "programme delivery partner" for the Industrial Energy Efficiency Accelerator, which will encourage "innovative industrial efficiency technology with grant funding".

Of the £851 million worth of contracts awarded from 2016 - 2020, at least £204 million were awarded as call-offs on a framework.

Using Tussell's advanced frameworks analytics, we discovered that BEIS was a call-off buyer on f buyer on roughly 27 frameworks, having called-off fed 74 contracts across them across this period.

By value of identified call-offs, the largest of these frameworks were: Grants and Programmes Services, General Legal Advice Services (RM3786) and Public Services Network (PSN) Services (RM1498).

By the count of identified call-offs, the largest of these frameworks were: G-Cloud 11 (10 call-offs), General Legal Advice Services (RM3786) (9 call-offs), and Management Consultancy Framework 2 - Phase 1 Lots 1 & 2 (9 call-offs).

If you're looking to do more business with BEIS, these are the frameworks to get onto!

Across the same period BEIS only operated 2 frameworks itself, Smart Meter Load Control Device Trial and the Futures Framework, at a potential value of £542,000 and £300,000 respectively. From this analysis, it is clear that BEIS much prefers using external framework providers rather than running them itself.

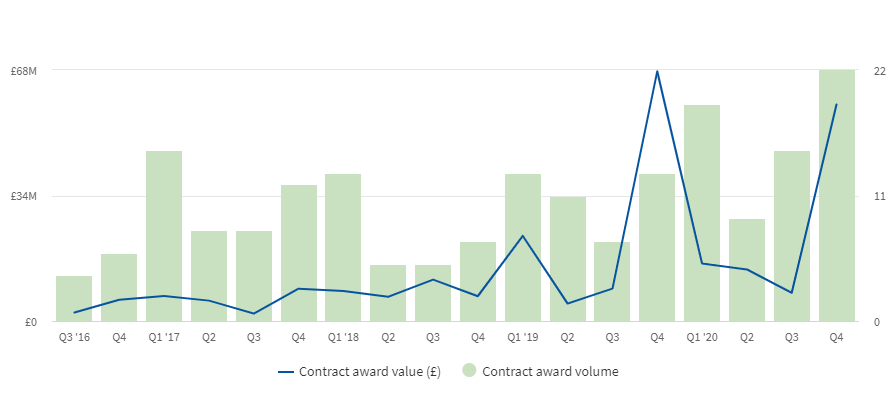

Of the £851 million worth of contracts awarded from 2016 - 2020, approximately £264 million - or 31% - was awarded to companies tagged as SMEs in Tussell's database.

As the above analysis indicates, the volume and value of contracts awarded by BEIS to SMEs have increased over the past four years. The final quarter of 2020 saw the highest quarterly volume of SME-awarded contracts and second-highest quarterly value.

If you're an SME, BEIS appears an increasingly promising buyer to turn to!

By sector, some notable suppliers and contracts have included:

|

Title |

Sector |

Award Value / Date |

Supplier(s) |

|

Consulting |

£8.53m / March 2020 |

UMI Commercial |

|

|

Administration, Defence and Social Security |

£6m / June 2016 |

Amport Risk |

|

|

Technical Services for Assessing the Energy Performance of Buildings |

Software |

£3.68m / June 2017 |

Aecom, Robust Details, Building Research Establishment |

|

IT |

£3.68m / March 2019 |

Visionist |

|

|

Construction / Consulting |

£850k / July 2019 |

Riskol Consulting |

If you're an SME, find out how to do more business with the public sector in Tussell's SME guide.

*

The Department for Business, Energy and Industrial Strategy is a public sector giant, spending billions on suppliers - large and small - across a range of sectors. This profile only skims the surface of BEIS' expansive procurement landscape.

Want to dig even deeper? Tussell's market intelligence platform lets you explore BEIS's - and all public sector buyers' and suppliers' - spend, contract awards, favoured frameworks and more!

Book a demo with our team to see how Tussell can let you make more informed business decisions in the public sector.

Find our other Buyer Profiles here:

%20v1.png)

.png?width=1280&height=800&name=LinkedIn%20+%20Twitter%20Link%20Posts%201200%20x%20628px%20(1).png)

.png?width=80&height=80&name=james%20v2%20(1).png)