The UK Home Office is responsible "for immigration and passports, drugs policy, crime, fire, counter-terrorism and police".

To help fulfil its responsibilities, the Home Office has awarded over £18 billion in contract awards to private suppliers since January 2016. This makes the Home Office the 3rd largest public authority by total contract award value.

Using our market intelligence platform, this buyer profile digs into these contract awards - and much more - to reveal rich insights into the Home Office's procurement behaviour. With this hard data, you'll be in prime position to win more business from this procurement giant.

Skip ahead to read about the Home Office's:

Find our other Buyer Profiles here:

- Department of Health and Social Care

- Ministry of Defence

- Ministry of Justice

- Department for Transport

-png.png?width=680&name=1(1)-png.png)

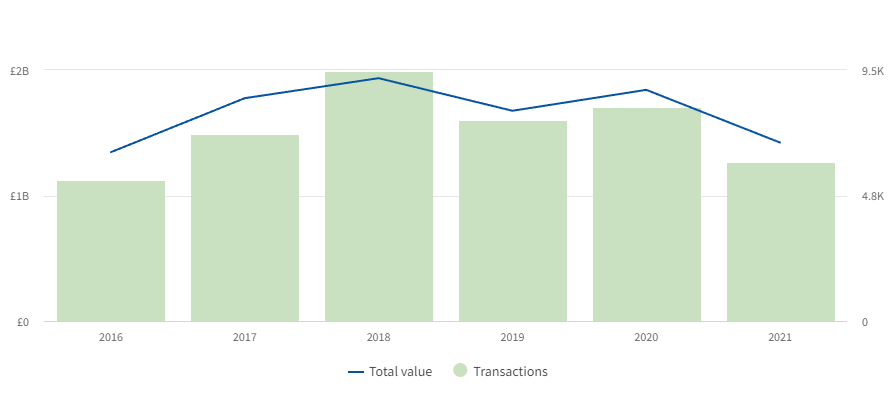

The Home Office has spent nearly £10 billion with private suppliers since January 2016, covering over 43,000 transactions.

As the above graph indicates, annual spend with suppliers has largely flatlined since 2016, ranging from £1.3bn in 2016 to £1.9bn in 2018.

From January 2016 to November 2021, the Home Office's largest suppliers by total spend were:

|

Supplier / Organisation |

Sector |

Total Invoice Value |

Largest Listed Spend |

Value / Date |

|

Airwave Solutions Ltd |

Emergency Communications |

£1.33bn |

Digital Data & Technology (IT Run Cost) |

£23.8m / March 2021 |

|

EE Ltd |

Tele-communications |

£483m |

CPFG - Crime Policing & Fire Group (Professional & Admin Services) |

£11.2m / March 2018 |

|

Mitie Care & Custody Ltd |

Immigration Services |

£386m |

UK Immigration Enforcement (Public Order, Security & Safety Services) |

£3.19m / July 2018 |

|

Cushman & Wakefield Debenham Tie Leung Ltd |

Real Estate |

£347m |

Corporate Enablers (FM Allocation Control) |

£18.9m / June 2021 |

|

Fujitsu Services Ltd |

Information & Communications |

£337m |

Digital Data & Technology (System Clearing) |

£4.89m / Jan 2019 |

-png.png?width=680&name=2(1)-png.png)

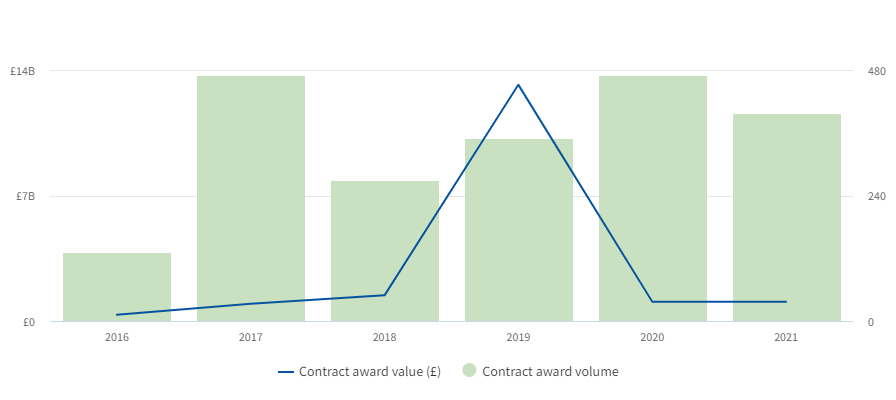

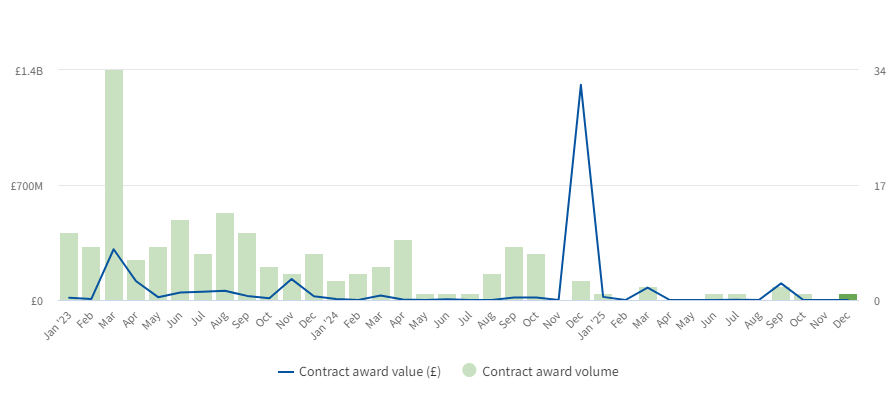

From January 2016 - November 2021, the Home Office has awarded at least 2,090 contracts to over 870 suppliers, valued at approximately £18.1bn.

As the above analysis shows, a substantial chunk of this value came in 2019 after numerous 'Asylum Accommodation and Support Services' contracts were awarded across the country. The largest of which - Asylum Accommodation and Support Services Contract South, awarded to Mears Ltd, Clearsprings Ready Homes Ltd, Serco Ltd and others - was valued at £3.25bn.

The annual volume of Home Office contract awards is fairly inconsistent, nor has it strongly correlated with annual contract value.

Over this period, the Home Office's largest contract awards - excluding AASS related contracts - included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

Nov 2019 |

£1bn |

Tekever Ltd |

|

|

Emergency Services Network - Lot 3 Mobile Services - Contract Variation |

July 2019 |

£681m |

Everything Everywhere Ltd |

|

April 2018 |

£514m |

Mitie Care & Custody Ltd |

|

|

May 2019 |

£410m |

Motorola Solutions UK Ltd |

|

|

June 2020 |

£281m |

The Salvation Army |

.png?width=680&name=7(1).png)

Tussell's platform identified 179 likely-to-be-renewed contracts * - with a total award value of £2.38bn - that are due to expire from 2023 - 2025.

The spike in upcoming renewal value comes from the expiration of two large Emergency Services Network contracts with Everything Everywhere and Motorola Solutions UK.

Notably, 45 of these contracts - valued at £453 million - were call-offs from a framework. This means that upcoming opportunities to do business with the Home Office lie predominantly outside framework agreements: welcome news if you're not currently on frameworks utilised by the Home Office.

The largest of these contracts - that were not call-offs - include:

|

Contract Title |

End Date |

Award Value |

Supplier(s) |

|

Dec 2024 |

£900m |

Everything Everywhere Ltd |

|

|

Dec 2024 |

£410m |

Motorola Solutions UK Ltd |

|

|

Sept 2025 |

£96.4m |

Leidos Innovations UK Ltd |

|

|

Service and Maintenance of Fixed Mobile RN Detection Equipment |

March 2025 |

£75m |

Leonardo MW Ltd |

|

March 2025 |

£70m |

Serco Ltd |

* "likely-to-be-renewed" is defined as 'services' and 'supplies' contracts

-png.png?width=680&name=3(1)-png.png)

Since 2016, the Home Office has awarded contracts to at least 658 suppliers.*

The Home Office's top suppliers - by total contract award value - were:

|

Supplier |

Sector |

Total Contract Award Value |

Largest Listed Contract |

Contract Value / Award Date |

|

Serco Ltd |

Public service provider |

£3.19bn |

£3.25bn / Jan 2019 |

|

|

Mears Ltd |

Housing and social care |

£2.9bn |

£3.25bn / Jan 2019 |

|

|

Clearspring Ready Homes Ltd |

Housing |

£2.65bn |

£3.25bn / Jan 2019 |

|

|

Tekever Ltd |

Surveillance |

£1bn |

£1bn / Nov 2019 |

|

|

Mitie Care & Custody Ltd |

Immigration Services |

£789m |

£514m / Apr 2018 |

The suppliers with whom the Home Office awards contracts most frequently includes Vision-Box Systems (28 total contract awards), Softcat PLC (23 total contract awards), Capgemini UK PLC (21 total contract awards) and Computacenter UK Ltd (15 total contract awards).

* This figure includes subsidiaries.

.png?width=680&name=6(1).png)

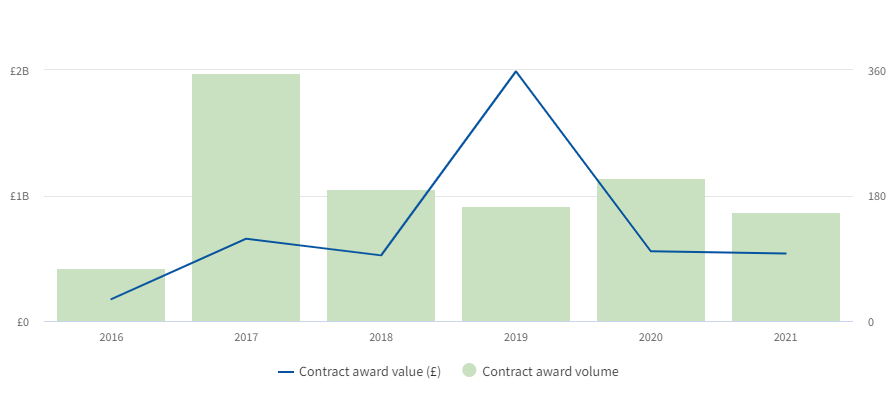

Below is a breakdown of the Home Office's IT and consultancy contract awards from 2016 - November 2021. This analysis was conducted using CPV codes, meaning the data may include some anomalous results.

IT and Software (CPV: 48000000, 72000000, 42960000)

Since 2016, the Home Office has awarded over approximately 1,100 IT and software related contract awards, at a value of £4.4bn.

As the above graph indicates, the total value of these contracts has remained relatively stable since 2016, peaking in 2019 alongside the aforementioned Emergency Services Network contracts.

The largest suppliers in this sector - by total contract award value - were Motorola Solutions UK Ltd (£707m), Everything Everywhere (£681m), Capgemini UK PLC (£220m), Fujitsu Services Ltd (£198m) and Sopra Steria Ltd (£170m).

The largest contracts in this period included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

July 2019 |

£681m |

Everything Everywhere Ltd |

|

|

May 2019 |

£410m |

Motorola Solutions UK Ltd |

|

|

Public Cloud Hosting Services - One Government Value Agreement |

Nov 2020 |

£120m |

Amazon Web Services UK Ltd |

|

Oct 2019 |

£96.4m |

Leidos Innovations UK Ltd |

|

|

Apr 2018 |

£94m |

Sopra Steria Ltd |

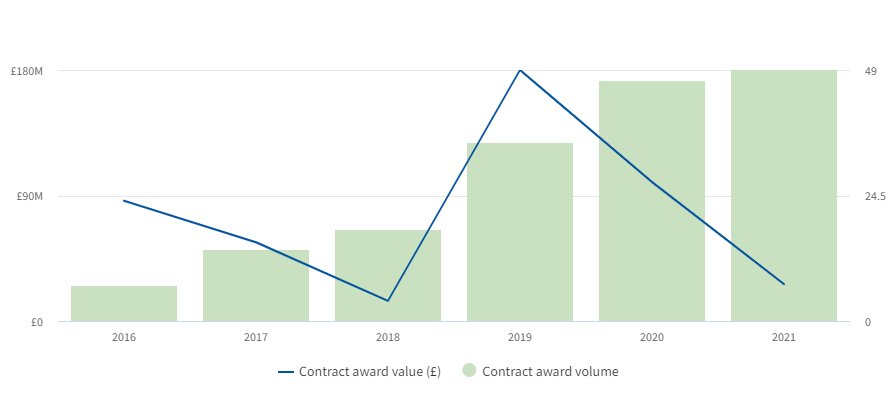

Marketing, Recruitment, Consultancy (CPV: 79000000) *

Since 2016, the Home Office has awarded approximately 170 consultancy-related contracts, at a total value of £463m.

As the above analysis indicates, while the volume of consultancy-related contracts awarded has increased year-on-year this has not resulted in a corresponding rise in value.

The largest suppliers in this sector - by total contract award value - include M&C Saatchi UK Ltd (£111m), Sopra Steria Ltd (£64.6m), Deloitte LLP (£60.1m), Mitie Ltd (£31m) and Teleperformance Ltd (£22.8m).

The largest contracts in this period included:

|

Title |

Award Date |

Award Value |

Supplier(s) |

|

May 2020 |

£64.6m |

Sopra Steria Ltd |

|

|

May 2016 |

£60.7m |

M&C Saatchi UK Ltd |

|

|

Aug 2019 |

£60m |

Deloitte LLP |

|

|

Feb 2019 |

£50m |

M&C Saatchi UK Ltd |

|

|

Sept 2017 |

£26.4m |

Not listed |

* To yield more consultancy-tailored data, the search behind this data did not include references to 'AASC', 'Escorting', 'ESN' or 'Immigration'

.png?width=680&name=4(1).png)

Of the 2,090 contracts awarded by the Home Office since 2016, 650 - or nearly 1/3rd - have been identified as call-offs from a framework.

Using Tussell's frameworks analytics, we can see the total value of these call-offs sat at approximately £1.71bn and spanned 69 frameworks.

By value of identified call-offs, the Home Office's most valuable frameworks include Technology Services 2 (£294m), G-Cloud 12 (£169m), Digital Outcomes & Specialists 4 (£161m), Digital Outcomes & Specialists 2 (£129m) and Facilities Management Marketplace (£91.4m).

By the total count of identified call-offs, the Home Office's most heavily utilised frameworks are Digital Outcomes & Specialists 2 (82 call-offs), G-Cloud 11 (59 call-offs), Technology Products 2 (57 call-offs), Technology Products & Associated Services (53 call-offs) and G-Cloud 9 (50 call-offs).

Across this period, the Home Office has operated 25 frameworks of their own, but only called-off 21 contracts from them at a value of £8.32m (with the National Framework Agreement for the Supply of Conducted Energy Devices being by and far the most utilised). This strongly indicates that the Home Office prefers calling-off contracts from externally created framework agreements, rather than harnessing their own.

*

The Home Office procures billions of pounds worth of goods and services every year. With data-driven insights and analysis behind you, your business can do more business with this procurement leader.

This analysis only covers the surface of what Tussell's aggregated data platform can tell you about public sector. With Tussell, you can analyse spend, contract awards, favoured frameworks and more across the public sector, helping you make more informed decisions when selling to the public sector.

Book a demo with our team to see how Tussell can unlock insights for your public sector business strategy.

Find our other Buyer Profiles here:

%20v1.png)

.png?width=80&height=80&name=james%20v2%20(1).png)