Whether you're a seasoned veteran or a new entrant to the field, there are always ways you can improve your public sector business development strategy.

Using a data-driven approach, you can better engage, anticipate and pitch to your key prospects.

This blog explores 4 ways you can boost your public sector business development strategy, and how Tussell's public sector market intelligence platform can unlock new insights and opportunities for your business!

🎯 #1 Scheduling engagements with spending 'dumps'

Public sector authorities sometimes spend large portions of their budget in specific months of the year, often coinciding with the start or end of their fiscal cycle. This is especially true for authorities with smaller budgets like local councils.

Knowing when these offloads typically occur for your sector will allow you to time your engagements with authorities more effectively, giving more opportunities to build rapport and understand their needs. Seeing who's winning the lion share of these spending spikes - and the services they currently provide - will mean you can make your engagements more informed and competitive.

So when are these spikes? Unhelpfully they differ from authority to authority, and their timings can often defy common expectations.

Rather than guestimating, Tussell allows you to easily identify these spending dumps:

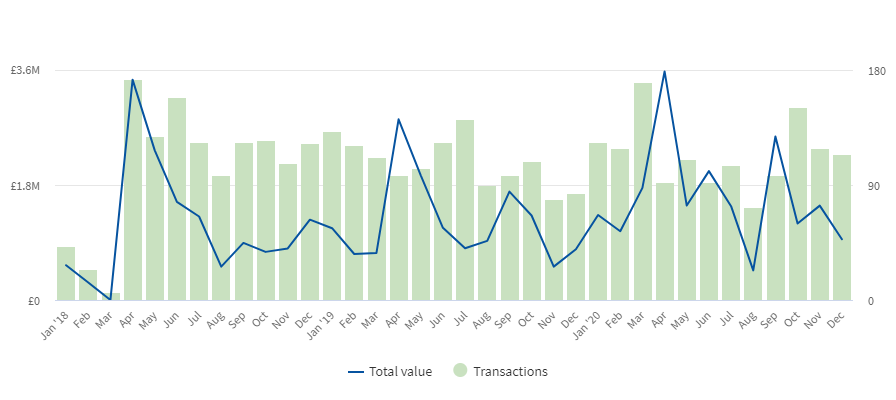

Using the example of spend on IT and software related suppliers, Tussell's data shows that Norfolk County Council sees a spending spike on IT and software in April.

Lancashire County County, by contrast, sees an uptick in IT and software investment two months later in June.

Knowing these slight differences in spending dumps proves vital when timing your engagements - being a month or two out of sync with your prospect represents lost time to hone your relationship with them.

💡 #2 Contextualising your offer vs. accounts' priorities

Getting the broader picture of a prospect's procurement priorities will mean you're more informed when formulating bids for them.

The essential question to answer is: "how can I make sure my services are aligning with this prospect's procurement priorities?"

One way to do this is analysing their largest contract awards in a given sector, seeing what they cover and who they awarded to. For central and local authorities, this analysis might cover contracts worth over £50 million and £10 million respectively.

From this, you can begin to infer where the prospect's priorities lie and understand where you sit in relation to them. You may not bid directly on these larger contracts, but you can discern whether your products and services align with the prospect's objectives: do you offer something similar, better, complimentary, or might it be best to shift focuses elsewhere?

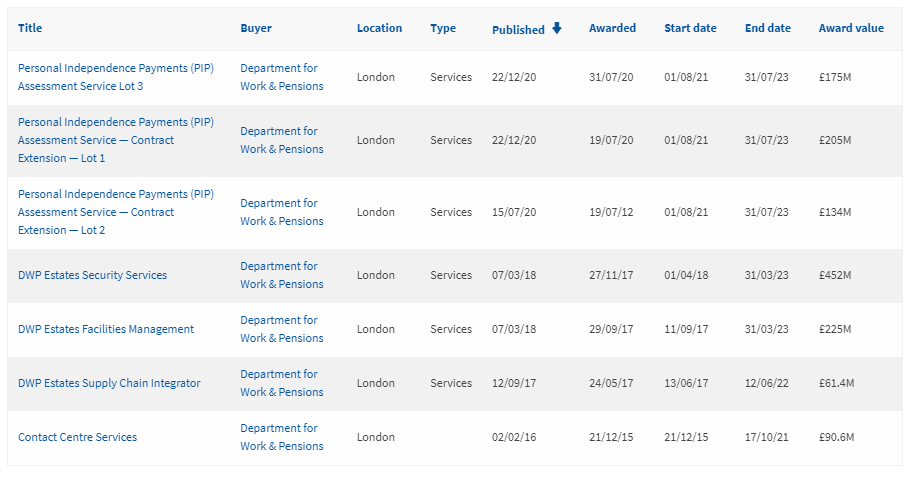

In the example below, we've searched the Tussell database for 'services' contracts awarded by the Department for Work and Pensions worth over £50 million.

The DWP has invested heavily in the delivery of 'Contact Centre Services', "a platform that supports multi-media, multi-channel and multi-skilled citizen / user / customer interaction".

If you're a technology or software company, the question becomes how your current services might complement or improve this contact centre - do you align with the requirements of the centre, and could you aid in its future operations?

Another way of understanding a prospect's procurement priorities is to dig into their published material. If you're targeting central government departments, for example, it's worth keeping up-to-date with the Cabinet Office's Procurement Policy Notes. These set out the government's big-picture endeavours for procurement, including changes in procedure and priority; only recently did PPN 08/21 put pressure on suppliers to pay their supply chain invoices promptly.

Other sources of insight include:

-

Published procurement pipelines

-

Council meeting minutes

-

Annual spending reports

-

NAO reports

-

Events, etc.

Compiling this research means you'll be well informed as to your prospect's priorities, better anticipate upcoming demand, and produce more relevant and appealing bids.

📈 #3 Get early indications of upcoming demand

Anticipating where future demand lies is fundamental to a successful public sector business development strategy.

Doing so is - obviously - much easier said than done, but by digging deep into public sector data some early indications of upcoming demand can be inferred.

One way of doing this is to see what low-value contracts prospects are awarding now which may serve as indicators of future larger contracts. This is especially true in sectors like consulting, where smaller preliminary 'discovery' and research contracts sometimes precede bigger project contracts down the line.

Using Tussell, we filtered for consultancy related contracts awarded by the Department for Digital, Culture, Media & Sport worth under £500,000 in the last 12 months. Here are some noteworthy contracts, and what future demand it might indicate:

|

Contract Title |

Contract Description |

Future demand? |

|

"to provide technical and consultancy support to transition from the legacy online platform solution to a new Google Cloud Platform" |

DCMS may require future assistance in operating and best utilising its new Google Cloud Platform once the transition is complete. |

|

|

To aid the Digital Identity Policy team with "technical skills", "expert advice, analysis and recommendations on legislative proposals" |

'Discovery' contracts strongly indicate areas of interest; more work surrounding 'Digital Identity' is likely to arise in the future. |

|

|

Mobile Alerting Technical Authority Services & Technical Consultancy Services for Mobile Alerting/Cell Broadcast |

To support the delivery "mobile alerting capability in the United Kingdom". |

The awarding of these two Mobile Alerting contracts in quick succession infers mounting priority is being allocated to the project, and a future need to regularly maintain and test the system. |

With data behind you, trying to anticipate your prospect's future priorities need not be a guessing game.

Another way of judging future demand is to keep up-to-date with published material. If you're an energy, engineering or technology firm, for instance, it's well worth digging into something like the Net Zero Strategy to understand which sectors are to receive greater government funding and interest.

🏗️ #4 Get smart with framework priorities

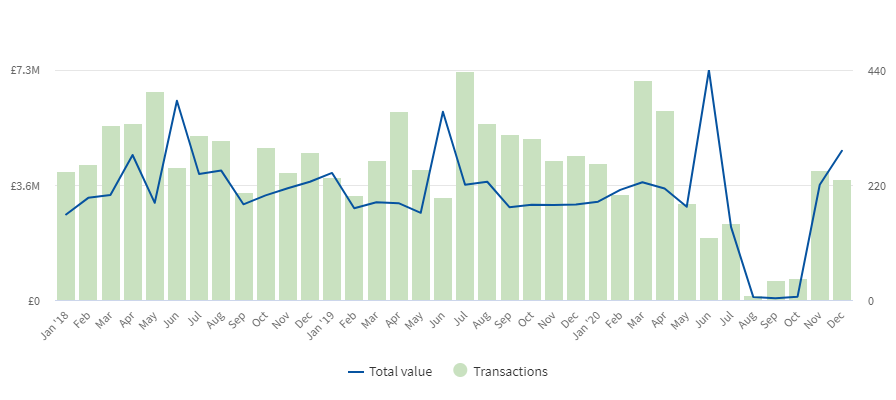

More and more contracts are awarded via frameworks: in 2020, £14 billion worth of contracts were call-offs from a framework! Being on the right frameworks has never been more important.

Applying for frameworks can be a very time-consuming process, so ensuring you're prioritising the most relevant and valuable frameworks for your business is key.

Several metrics can be used to judge which frameworks are worth prioritising: which frameworks are regularly used to award call-offs in your sector? Which frameworks are your competitors or partners on? Which frameworks tend to award contracts with a value in your business' ballpark? Which frameworks do your target accounts regularly utilise?

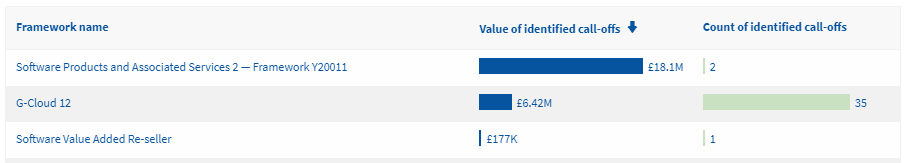

How does this look in practice? In the below example, Tussell's frameworks analytics identified the top frameworks called-off by local authorities for cloud service related contracts in 2021. The analysis indicates that while G-Cloud 12 is used most frequently by far, more valuable cloud contracts are procured through Software Products & Associated Services 2.

This kind of analysis funnels down which frameworks to prioritise applying for, and which you need to remain on.

To dive deeper into how Tussell can help you easily find, analyse and compare frameworks, read our recent blog, Procurement Frameworks: How to Find the Best Ones for You.

*

Data-driven insights boost your public sector business development strategy, letting you better understand your prospects, build better relationships with them, and create more tailored bids.

Harnessing these insights is made so much easier with Tussell because we collect, aggregate and clean public procurement data for you into a one-stop platform. Book a demo with our team to see how Tussell can help you deepen your public sector business development strategy!

%20v1.png)

.png?width=80&height=80&name=james%20v2%20(1).png)