Selling to the public sector is a complex and difficult task, let alone doing so within one of its most well-entrenched markets - the recruitment sector.

What does this competitive marketplace look like today, and what might it look like in the not-so-distant future?

In this guide, we've teamed up with specialist talent attraction organisation, Sanderson Government and Defence (G&D), to lay out what's shaping this critical sector today, the main risks and challenges faced by suppliers, and what trends you should be looking out for.

With over 25 years of experience supplying security-cleared professionals into the UK secure government markets, Sanderson G&D's client portfolio includes both public sector organisations as well as a range of established system integrators supplying into the public sector.

Skip ahead to read about:

-

What does the public sector recruitment market look like today?

-

What trends are shaping the public sector recruitment market?

- Concluding remarks

📊 What does the public sector recruitment market look like today?

Tussell's recent Recruitment Market Snapshot provides a data-led picture of what the public sector recruitment market looks like today.

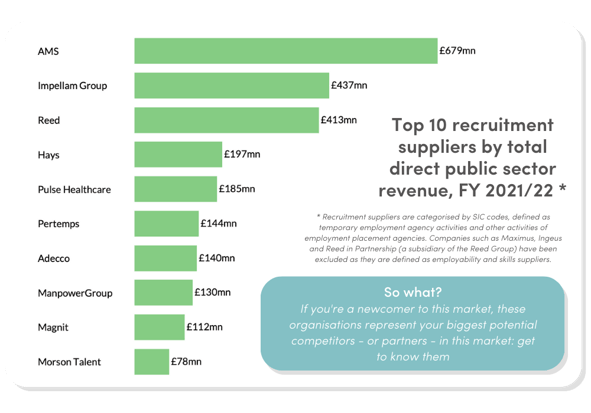

The Snapshot shows that the sector's top 10 suppliers have well and truly embedded themselves within the market. These 10 firms received 63% of all direct spending that went to recruitment suppliers in FY2021/22.

By contrast, SMEs occupied 19% of the market.

AMS came out as the highest-earning supplier in this period. A nearly £250mn revenue gap stood between them and the second-highest earner, Impellam Group.

The market's biggest buyer by total direct public sector spend in FY2021/22 was Network Rail, spending £164mn across their recruitment suppliers. They were followed by DHSC, the DWP and TfL.

The data also showed that frameworks are a fundamental route-to-market within this sector, with at least 66% of recruitment-related contracts being awarded via a framework in 2022. The top 10's success was driven largely by their ability to capitalise on the right framework agreements.

What does this all mean?

Our analysis indicates that the sector's top players hold a firm grip over the market - to gain ground, you need to understand who they are, who they're working heavily with, and which routes-to-market they're harnessing to get ahead.

Want to dig into the data yourself?

Download our Recruitment Market Snapshot for free.

💡 What trends are shaping the public sector recruitment market?

With this data-backed overview in mind, we asked Sanderson G&D: what key trends and issues are driving the public sector recruitment market today?

🏆 The top 10 suppliers

Our data makes clear that a small handful of firms largely dominate this space.

Whilst suppliers such as AMS, Impellam Group and Reed are occupying the bulk of the market, this also makes it easier to identify your competition and/or potential partners that you can use as a route-to-market.

If you are a newcomer to this market, these companies represent your biggest potential competitors. You need to be both aware and prepared to come up against these suppliers when bidding on contracts.

Ask yourself: what do they offer that we don't? Where are our offerings similar? How can we stand apart from them? How might we compliment their offerings?

You can find out more about how the top 10 suppliers are performing in this sector, who they are doing business with and their framework usage, in our recent Public Sector Recruitment Market Snapshot.

🏢 Changes in working environments

The pandemic took the public sector by storm, dramatically changing and enlarging the role of recruitment businesses.

Sanderson G&D commented on the post-COVID working environment, acknowledging that the enhanced hybrid working demands from applicants are leading to suppliers and government departments needing to adapt to more flexible working arrangements in order to recruit and retain talent, especially in the secure government markets.

The evidence and trend progression suggest that the UK will not go back to the same pre-COVID working environment as work will be carried out more and more remotely or in a hybrid set-up.

🎓 Continued skills gap

The UK is currently experiencing a skills shortage, with the tech market having the biggest gap.

Sanderson G&D commented that they anticipate a continued retracted applicant-driven market for the foreseeable future, meaning there will be a deficit of suitably qualified and cleared applicants to meet the demands in the UK public sector moving forward.

Bridging the gap between skill supply and demand requires urgent attention in order for government departments to meet their objectives.

Sanderson G&D said that the government's recent creation of the Department for Science, Innovation and Technology (DSIT) was a strong start to finding a solution for this problem. However, companies in this market will face the challenge of demand outstripping supply for some time to come.

Sanderson G&D works to look further than traditional resourcing methods, moving towards more partnership-driven embedded talent acquisition models and models such as Recruit, Train, Deploy, to help solve the skills gap for the future.

📝 Procurement hurdles

Sanderson G&D were quick to comment on how burdensome the procurement of contracts in the public sector can be nowadays - as well as the recruitment processes for candidates.

They explained they are challenging clients to move away from the long recruitment process with multiple stages and move toward a more fit-for-purpose streamlined resourcing model. In reality, this means that complex leadership-based initiatives will be needed - but these must remain measurable and transparent.

Whilst, the tendering process is designed to ensure competitiveness, fairness and transparency, it has created a complex system that is hard for HR and recruitment suppliers to navigate. They may need to invest a significant amount of time and resources in preparing bids, responding to questions, and attending meetings. The same effort will be required even for contracts with a low value.

Public sector contracts in the UK often come with strict compliance requirements, particularly around data protection and security. HR and recruitment suppliers may need to demonstrate compliance with a range of regulations, policies, and standards, such as the GDPR and cyber security regulations. This can be particularly challenging for smaller suppliers who may not have the resources or expertise to meet these requirements.

💷 Pricing problems

Additionally, some public sector contracts in the UK come with long payment terms, which can be a challenge for HR and recruitment suppliers who need to pay their own staff and contractors in the meantime. Late payments can cause cash flow issues and impact the ability of suppliers to deliver their services effectively.

Alongside this, competitive pricing can cause a hindrance to some suppliers in this market as public sector contracts in the UK often require suppliers to offer competitive pricing. This can be difficult for HR and recruitment suppliers in particular because they are already operating in a competitive market. As a result, suppliers may need to lower their margins to win contracts, which can impact the quality of their services.

🔮 What might shape the recruitment market in the future?

If you're already in the recruitment market, you've no doubt felt some of the trends outlined above. Newcomers to the market should keep them in mind when approaching the market.

But will these trends linger into the future? We asked Sanderson G&D what they thought would shape the public sector recruitment market in the near future. Here are their predictions:

👩💼 An applicant-driven market

Sanderson G&D predicts that the market will remain applicant-driven.

This will result in organisations needing to be more open-minded and offer more flexibility. For example, suppliers may need to explore the idea of flexible hours and compressed working weeks.

Additionally, suppliers could look at working with companies such as Sanderson G&D to work towards more targeted resourcing models and increasingly diverse talent pools.

🤖 Impact of technology

Sanderson G&D also said that technology looks set to continue to make changes within the sector. Conversations around the practicalities of implementing technologies like AI into the UK government market are ongoing.

AI can be used to automate complex tasks, such as candidate matching and assessment, and can even be used to develop predictive models to forecast future staffing needs.

Automation has already had a big impact on technology in the sector so far, and this looks set to continue to grow with software that can automate some of the manual processes involved in recruiting, like candidate screening and scheduling interviews. This can save time and improve efficiency, allowing HR and recruitment professionals to focus on higher-level tasks.

Augmented reality (AR) is another technology that could have an impact on the HR and recruitment market. AR could be used to provide immersive training experiences for new hires, and could even be used to simulate job tasks to assess candidates' skills and abilities.

📜 The Procurement Bill

One of the key objectives of the Procurement Bill is to simplify procurement processes, making it easier for public sector organisations to buy the goods and services they need. This could include simplifying the tendering process for recruitment contracts and reducing the kind of administrative burdens mentioned by Sanderson G&D above.

The Procurement Bill also intends to provide greater flexibility in procurement, allowing public sector organisations to work with suppliers in a more collaborative way. As a result, recruitment suppliers may benefit from this more than suppliers in other markets as it could include more innovative and creative approaches to recruitment, such as strategic workforce planning and talent management.

To find out more about what the Procurement Bill is and what it means for you, check out our recent blog.

*

Time will tell how successfully the Procurement Bill reduces administrative hurdles for suppliers, or whether AI will reshape the sector as we know it.

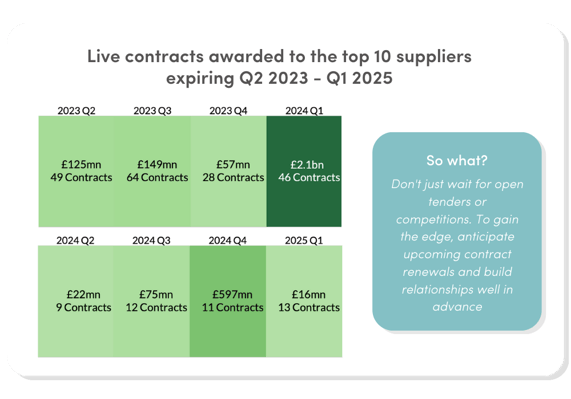

What we can be more certain of is when live recruitment contracts are due to expire in the near future.

Our Recruitment Market Snapshot indicates that over £2.6bn worth of contracts held by the top 10 recruitment supplies are due to expire in 2024.

To truly make headways in this market - or any public sector market - you can't just react to tenders when they land, but proactively anticipate when opportunities may come in. You need to build relationships and stake your case well ahead of time, allowing your bid to land with more impact when the tender comes around.

We've written multiple how-to guides aimed at helping you level-up your public sector sales approach. You can access all our Resources, for free, here.

Concluding remarks

It is clear that the public sector recruitment market is a lucrative marketplace, with plenty of opportunities to build future business.

Take heed of the trends identified by Sanderson G&D, and see how you might get ahead of forces like AI and the Procurement Bill to stay on top of this competitive marketplace.

To get a data-backed overview of the public sector recruitment market, have a look at our recent snapshot on the market.

To learn more about the expertise and services provided by Sanderson G&D, check out their website.

*

We have lots more resources to help you sell more to government - check out some of our other how-to guides:

🟢 How to build a pipeline of public sector procurement opportunities

🟢 Procurement Frameworks: How to find the best ones for you

%20v1.png)

.png?width=424&height=293&name=Recruitment%20Snapshot%20Graphic%20(2).png)