In the latest instalment of the Public Sector Sales Podcast chats, we sat down with Tom Sheppard, Managing Director of healthcare bid writers and tender specialists HealthBid, to discuss the procurement behemoth that is the NHS, and what you need to know if you want to start selling your goods or services to it.

We've condensed the key insights from our chat below, and you access the full interview on our YouTube channel.

Skip ahead to read about:

-

How does selling to the NHS differ from selling to other public bodies?

-

What does the bid/no-bid process look like for NHS opportunities?

-

What is the structure of the NHS, and how does this impact hopeful NHS suppliers?

🤔 How does selling to the NHS differ from selling to other public bodies?

Next to the comparatively simple structures of local and central government bodies, the deeply complex, interconnected nature of the NHS means "there is no simple way" of selling to it, argues Tom.

Baked into the NHS's structures are a much more "rigid" set of expectations as to how goods and services are delivered. Local authorities, by contrast, "tend to be a little more open and flexible" when negotiating how a service is delivered.

There is also a much more clear-cut distinction between the selling of goods vs. services to the NHS. With the former, a much clearer set of expectations arise: is the product good-value? Is it safe? Can they be delivered on time, and so on. With services, there are many more factors that determine whether it's of value to the NHS - how does its roll-out impact on other processes? If it's community-oriented, how does it maximise outreach and accessibility? The difference is "night and day" between selling goods and services to the NHS, says Tom.

Taken together, the NHS's complex structure, more rigid procurement ruleset, and high-bar for its products can mean the NHS almost seems like "it doesn't want to be sold to".

An organisation that doesn't want to be sold to?

Versus the commercial sector, the NHS is certainly a more suspicious organisation when being sold to, notes Tom.

In Tom's experience, NHS bodies are worried they will be "tricked into something", and that the profit-motive of private suppliers means they're "out to get you".

This engrained scepticism is perhaps to be expected of an organisation that is so politically charged: one that is both nationally admired and intensely monitored. With this pressure, any procurement decision carries an added weighting and necessity for careful scrutiny that isn't experienced by other public bodies.

An organisation that 'bids on its own contracts'?

Another unique aspect of selling to the NHS is that it isn't uncommon to be up against an NHS provider when bidding on an NHS contract.

This is a well-established practice, originating in the growing divergence of NHS providers and commissioners introduced in the 1990s.

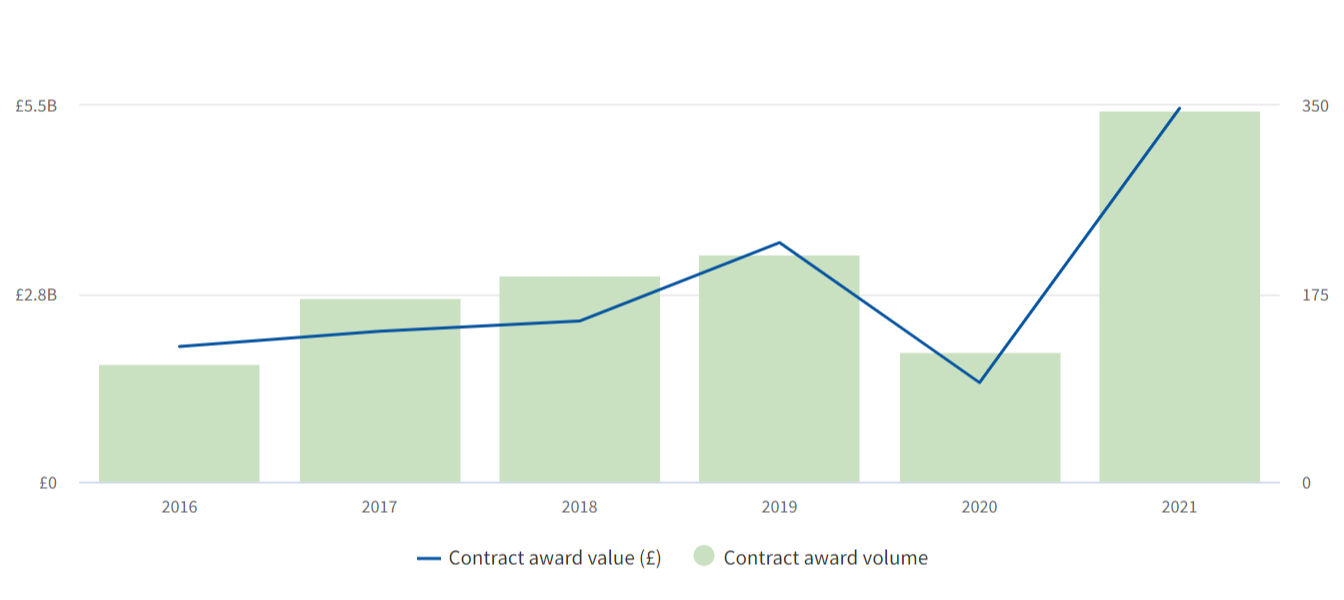

Tussell's market intelligence platform shows that NHS bodies won approximately £5.5 billion worth of contracts from NHS authorities in 2021.

In this example, Essex Partnership University NHS Foundation Trust won a £425k contract for asthma care services from NHS North Essex CCG.

The potential of facing an NHS provider in your bidding process may be somewhat intimidating but it isn't necessarily bad news, argues Tom. More and more, there is a recognition within the NHS that innovation lies more and more outside its walls than within them: when deciding the provider of certain services, therefore, it's increasingly in the interest of the NHS to opt for a private supplier than an NHS body.

Such NHS bodies, moreover, recognise that their 'purpose' lies less and less with providing certain services, particularly on the local level, like sexual health services or smoking cessation. The NHS has slowly "let itself lose these services", argues Tom. Instead, their capabilities lie in providing essential, complex services like A&E departments and operating theatres, that only one or two massive private suppliers could hope of providing otherwise.

The bad news is that when you are up against an NHS provider, you'll likely lose. It's often difficult for private suppliers to win against "the home team", as Tom puts it. Understanding whether you may be up against an NHS provider when deciding whether to pursue a tender, therefore, is critical to understanding your chances of success.

👍👎 What does the bid/no-bid process look like for NHS opportunities?

Tom notes a "certain naivety" among many private organisations that they can just bid on - and win - an NHS tender without much preparation. This is very rarely the case.

"The sales side of a bid can't be neglected: you can't just come to somebody like HealthBid and just win. We need to know: why should you win this? Who are your competitors? If you're a new startup, how are you going to beat an NHS provider who's been there for 30 years?".

An honest reflection on these kinds of bid/no-bid questions will determine whether the opportunity is worth pursuing, or if it'd be more worthwhile pursuing something else. With proper research into the market and your competition, combined with an assessment of your own capabilities, you won't be wasting your time on tenders that you were likely never going to win in the first place.

If you want more tips on how to make a more informed bid/no bid decision, read our 5 advanced techniques to enhance your bid/no-bid decision process.

🏥 What is the structure of the NHS, and how does this affect hopeful suppliers?

In place of discussing in-depth the whole of the NHS's complex structure, here are three key premises for suppliers to understand when tackling the NHS and looking for opportunities:

Providers vs. Commissioners

For Tom, the first basic premise for suppliers to understand is the difference between commissioners and providers - the former buys goods and services, the latter provides them. As discussed, the latter can bid on work tendered by the former, as can private sector organisations.

When approaching the NHS - and comprehending newer layers of the structure, like Integrated Care Systems - it's important to view it from the perspective of this premise: is this particular body commissioning or providing services? Opportunities lie in both.

In the case of commissioners, for example, are the more than 200 Clinical Commissioning Groups across England. With each covering a different geographic area, CCGs commission lots of services and present numerous opportunities per year.

Providers - like GP practices - also need to procure goods and services to operate. A surprising amount of this is done locally, offering many opportunities for suppliers.

Understanding this fundamental distinction can help simplify the often bewildering maze of the NHS's structures and bodies.

Where smaller suppliers should look for opportunities

The second premise is that most entrants to the market are not going to be selling straight to large organizations, like hospitals. New suppliers tend to assume that due to the visibility of institutions like hospitals, they are where most commercial opportunities lie - this is often not the case for new or smaller suppliers, argues Tom. Hospitals are "a massive hotel, a massive healthcare institution, a massive waste producer", on a scale unfit for most suppliers.

Opportunities, instead, lie mostly in community and local provision (or 'primary care'). This includes GPs, pharmacies, dentists etc. Many opportunities lie in providing the goods and services these primary bodies rely on daily.

Complexity = opportunities

Tom argues that one distinct advantage of having such a complex NHS structure means procurement opportunities originate from many, individual devolved bodies, rather than one single centralised body. This multiplies the opportunities hopeful suppliers have for doing business with the NHS.

This locally-devolved nature of the NHS, moreover, means hopeful suppliers shouldn't - nor cannot - aim to supply "to the NHS" as a whole, argues Tom. You can breakdown the NHS into its constitutent parts, and find opportunities within them - certainly when starting out - but targetting your sales strategy "to the NHS" is largely meaningless.

📊 What is the role of data when selling to the NHS?

Data is essential during the bid/no-bid, pre-bid and solution design phases, argues Tom.

When deciding on whether to bid on a tender, for example, if the data shows that one NHS Trust hasn't changed its IT supplier in 30 years, but a Trust in the county over has changed supplier every 5 years, you're much more likely to win an IT contract from the latter. Immediate data like this provides crucial indicators as to whether an opportunity is worth pursuing.

During the bid-writing phase, data is critical to writing an informed, convincing bid. Any data you have on the incumbent supplier(s), potential competitors and, critically, the needs and wants of the buyer will make you stand out.

Finally, if you have data on how the contract will operate, it will help you to price your proposal well - both to win the contract, and to craft your proposal in line with your budget.

💡 4 key tips for NHS newcomers

Here are Tom's 4 top tips for suppliers wanting to break into the NHS marketplace:

#1 Understand your product/service

First and foremost, you need to assess whether your product or service actually solves an issue being faced by the NHS - not something you've experienced personally or heard anecdotally - and whether it's addressing the problem adequately.

It's also necessary to understand how your product or service will interact with the ecosystem of other products and services used in your particular area. If the implementation of your healthcare monitoring software, for instance, has a knock-on effect for how quickly certain processes and workflows operate, or requires 10 weeks of additional training, it's crucial to understand these 'additional' costs.

This is where proper market research on the NHS's incumbents, and the NHS's problems, is key.

#2 It's a long game

It's rare for a supplier to win an NHS contract on their first try. It takes multiple attempts, and can often be dispiriting. Tom warns that the NHS has a particular proclivity to inviting prospective suppliers in for numerous meetings and demos, without ending up in a sale - be wary of this before getting your hopes too high!

#3 Speak the NHS's language(s)

Different NHS bodies speak in different ways; honing your bids towards these different dialects will greatly boost your perceived credibility. Don't assume that a particular buyer will speak industry-standard language: more often than not, they'll refer to products, processes and services in a NHS-particular way.

#4 Don't try selling to the entirety of the NHS

For Tom, the single biggest mistake made by hopeful NHS suppliers is that they believe they're selling "to the NHS". With some small exceptions, you will be selling to a local NHS body: say, a group of GPs in a county, or a hospital in a town.

This localised nature is critical to appreciate when preparing your bid. When bidding on a local hospital's contract, for example, you need to demonstrate an understanding of that specific hospital's needs and requirements, not the national picture. Concurrently, you need to show how your proposal will benefit them specifically, and that your proposal's accommodated to their area's particular demographics and infrastructure where relevant.

*

The NHS is a procurement behemoth: many have tried to sell their goods and services to it, but many have left disappointed.

As Tom argues, the first step for hopeful - and even many incumbent - suppliers is to recognise and appreciate the NHS's inherently complex, localised and often sceptical nature. From this, you need to manage your expectations of easily securing work within the NHS, but also understand that many opportunities for work may lie in places you wouldn't immediately expect.

With this perspective in mind, and specific data and research behind you for each bid, you'll be in a much better position to begin effectively selling your goods and services to the NHS.

You can listen to the full discussion with Tom on our YouTube channel.

To learn more about Tom and HealthBid, view their website here.

You can read and listen to the other instalments of the Public Sector Sales Podcast here.

%20v1.png)

.png?width=80&height=80&name=james%20v2%20(1).png)