When done right, making the bid/no-bid decision for a public sector tender needs deep knowledge of the client's needs and characteristics, a frank judgement of your competitors, and an honest assessment of the capabilities of your own business.

This is no easy task: properly understanding your chances of winning a tender is a time-consuming and resource-intensive process.

Drawing on his experience in procurement and working as a bid consultant, we chatted with our very own Head of Marketing - Lloyd Johnson - to understand some advanced techniques for taking your bid / no-bid process to a whole new level.

This blog will help you understand how to make your bid/no-bid process more informed and, ultimately, more effective, saving your business time and money through better decision-making.

🤝 #1 Understand your competitors' embeddedness using hard data

When judging your chances of winning a tender, a critical consideration is evaluating how deeply involved the client is with your likely competitors, and any incumbent suppliers. If one of your competitors has a long-standing and embedded relationship with a prospect, they have an immediate advantage when bidding on contracts with them.

Due to the relative transparency of data in the public sector, evaluating these relationships doesn't need to be purely qualitative: "you can know for certain how embedded your competitors are with reliable quantitative analysis", says Lloyd.

"You can remove the uncertainty of understanding how embedded a competitor is because you can actually see the change in spending over time, the change in contract awards over time, or if they've won something recently: these all serve as indicators of how embedded a competitor is."

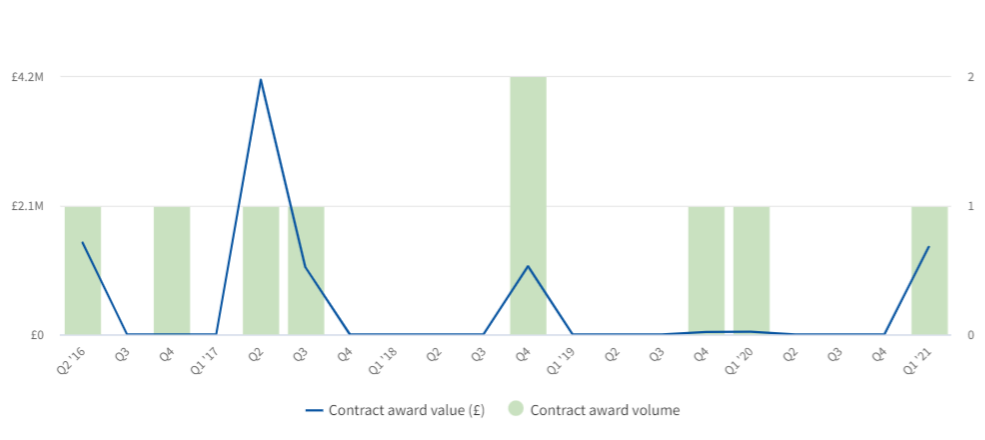

To see what this looks like in action, we harnessed data from Tussell's market intelligence platform to evaluate the embeddedness of a competitor for an NHS Blood & Transplant contract.

A Microsoft Azure Services contract was awarded by NHS Blood & Transplant to Trustmarque Solutions Ltd in January 2021, and is due to expire in March 2022. Using hard data, we can evaluate how embedded Trustmarque's relationship with NHS Blood & Transplant is, informing how likely you would be to win a similar contract if it was re-tendered.

Tussell data indicates that Trustmarque has been awarded 9 contracts from NHS Blood & Transplants since 2016, worth approximately £9.4 million. From this, we can judge that their relationship is quite firmly embedded: the client has awarded the competitor contracts on a semi-regular basis; the value of these contracts have been quite high, and the services provided across these contracts are broadly similar to what would be required if the target contract were re-tendered (i.e. delivering Microsoft products)

This data-driven approach gives strong indicators of how embedded your competitor(s) is with the client, and should weigh heavily in your bid/no-bid decision process.

To understand how Tussell's market intelligence platform can do even more for your bid/no-bid process, book a personalised demo with our team.

🎯 #2 Understand your client's underlying drivers

Lots of factors beyond your ability to meet the specifications of a tender will affect your chances of winning it. One group of factors are the client's underlying drivers and motivations, such as their values, policies and broader priorities.

Getting to the heart of these means "going through unstructured data to get an advanced understanding of a contract authority's intent. This includes things like meeting minutes for local councils, policy documents, wording in contracts that have been awarded": all of these sources contain "narratives that help portray the buyer's direction of travel".

Across these documents, you can begin to form a picture of the client's key priorities: are they environmentally focused? Do they heavily emphasise incorporating social value into their procurement processes? Do they seek to champion SMEs or locally-based businesses? Forming this picture of your client's motives will inform not only your bid/no-bid decision, but will mean you can tailor your proposal more specifically to your client if you do decide to bid.

When conducting a bid/no-bid process for a central government contract, for example, it's key that you keep up-to-date on the latest Policy Procurement Notes from the Cabinet Office. PPNs provide strong indicators as to the government's procurement priorities and direction.

In October, the government published PPN 08/21, increasing the threshold you have to meet to demonstrate you promptly pay companies in your supply chain before bidding on central government contracts worth over £5 million per year. Even if you're not bidding on contracts worth over £5 million, it's clear that the government seeks to champion and award suppliers who are paying their supply chain promptly: if you're not, this should definitely factor into your bid/no-bid decision process.

🔍 #3 Get smart with Freedom of Information requests

Harnessing Freedom of Information (FOI) requests is a surprisingly under-utilised tactic to get "pre-bid bid/no-bid information".

Once you've identified a contract which you think is likely to be renewed in the near future and that you'd consider bidding on, you can utilise FOI requests to fill in knowledge gaps ahead of the bid/no-bid process. "You can ask for things like supplier performance levels, the type of technology they have in the place, their priorities in different areas, who's leading certain projects", and so on.

"You can basically ask whatever you want in an FOI request. There's obviously no guarantee you'll get the information you ask for, but it's more about using them tactically ... to smartly fill in the gaps of information you need to make an enhanced bid/no-bid decision".

"Proactively using FOI requests in good time before a tender's release means the bid/no-bid process almost becomes a formality, as you've filled in the gaps ahead of time".

This comes with an important caveat. Due to the public procurement rules you can't use this tactic if the tender's already released as your questions will need to be routed via the tender's e-tendering platform, not FOI requests.

To dig deeper into making an FOI request, read the government's advice page. Tussell customers also gain access to up to 20 anonymised FOI requests a month; to understand our FOI services in more detail, talk to our sales team.

📈 #4 Harness KPI data on your competitors

The government publishes KPI data on its 390 most critical contracts, outlining how adequately suppliers are meeting performance metrics.

If you're looking to bid on these major government contracts, "this data is absolute gold": "if the KPI data has been consistently green right up until the contract is due to conclude, that is a strong indicator the supplier is successfully fulfilling the contract. The inertia created by this success ramps up the cost of change, meaning they're quite likely to be awarded the contract again", either once it's renewed or extended.

"Conversely, not hitting the KPI target - especially over multiple reporting periods - is a pretty major public statement that things aren't going well; inertia won't set in, and there'll be motivation to change supplier(s)".

Contract performance data is a crucial nugget of information for your bid/no-bid process if you're looking to land these major government deals. Even if you're not directly bidding on these contracts, this data is still very valuable for subcontractors and partners.

"These major contracts have an ecosystem of smaller contracts surrounding them: if the main service is failing according to the KPI data, supplementary opportunities may arise for smaller companies looking to bid on these related contracts. When smaller companies are writing their bid documentation, they can speak to a known problem being experienced by the authority, and hone their bid around it".

Though KPI data is only publicly published for these 390 critical contracts, you could utilise FOIs to access the KPI data for other large government contracts, or to dig more deeply into specific contract's KPI metrics.

🧭 #5 Reflect on whether there's a better route to market

Finally, a more fundamental question you should ask yourself during - or before - the bid/no-bid process is whether bidding on a tender is the right approach for you at all. Other routes to market might prove more cost-effective and suitable for your position.

"If you're a small company and you're looking to get your foot in the door with a contracting authority, it might be more worthwhile selling your services and products below the tendering threshold to avoid the bidding process altogether". This will let you build a relationship with the client, and make winning future contracts easier.

"You can also sell indirectly as a subcontractor or tier-2 service provider." Once a supplier is awarded a contract, you can begin asking how you might aid them in delivering their contractual agreements, rather than being the main service provider.

A third way is to get smart with frameworks. If a contracting authority publishes a desirable tender outside a framework, but you're already a member of a framework they utilise, "you can accept defeat and not pursue the standalone tender but know in the future you can still sell similar or products or services via the framework without the need to bid". Properly utilising your place on frameworks is a viable alternative to spending valuable time and resources on an extensive bid/no-bid process for new tenders.

*

The importance of honing in your bid/no-bid decision process shouldn't be understated: countless hours and resources are wasted on pursuing unrealistic or ill-informed tender opportunities.

By making your process more knowledgeable and efficient, you'll not only make the 'correct' decision more often, but - more importantly - know when to say no.

Looking to improve how you do business with the public sector even further? Read our top 4 tips for boosting your public sector business development strategy, or see how Tussell's market intelligence platform could help you do more business with the public sector.

%20v1.png)

.png?width=80&height=80&name=james%20v2%20(1).png)