Having recently discovered that almost 250 procurement pipelines are set to be published by 2023, we partnered with Build UK, the leading representative organisation for the UK construction industry, to do some more detailed research on one of the most established, existing pipelines.

The National Infrastructure and Construction Procurement Pipeline is published by the Infrastructure and Projects Authority (IPA). It sets out the major projects and programmes that the government expects to procure over the next twelve months.

Scroll down to read on, or use the menu to skip to any section you like.

What does it cover? | What did we analyse? | What were the key findings? | What are the challenges with using the pipeline? | Recommendations for future pipelines | How suppliers can make the most of pipelines (despite their shortcomings)

What does it cover?

The current 2020/2021 pipeline includes up to £37bn of construction activity, covering everything from major upgrades of motorways to building new flood defences.

There are 284 lines of projects/programmes in total, covering 17 sectors. However, almost 70% of the initiatives fall into just four categories:

- Education

- Transport

- Housing and Regeneration; and

- Utilities.

What did we analyse?

We initially intended to analyse all 284 projects/programmes to understand how many of them had been tendered in line with the target dates in the pipeline, but quickly realised that wasn't feasible in a reasonable timeframe* (even with help of the Tussell platform, which makes light work of researching the UK public sector market).

*More on why this was difficult and our recommendations for improving pipelines, later in the article.

Instead, we opted to do a deep dive on the top 50 initiatives covering 10 of the 17 sectors. This accounted for just over £25 billion, or 70% of the total expected pipeline value.

What were the key findings?

In short, it was extremely difficult to reconcile the pipeline with published tenders and contract awards.

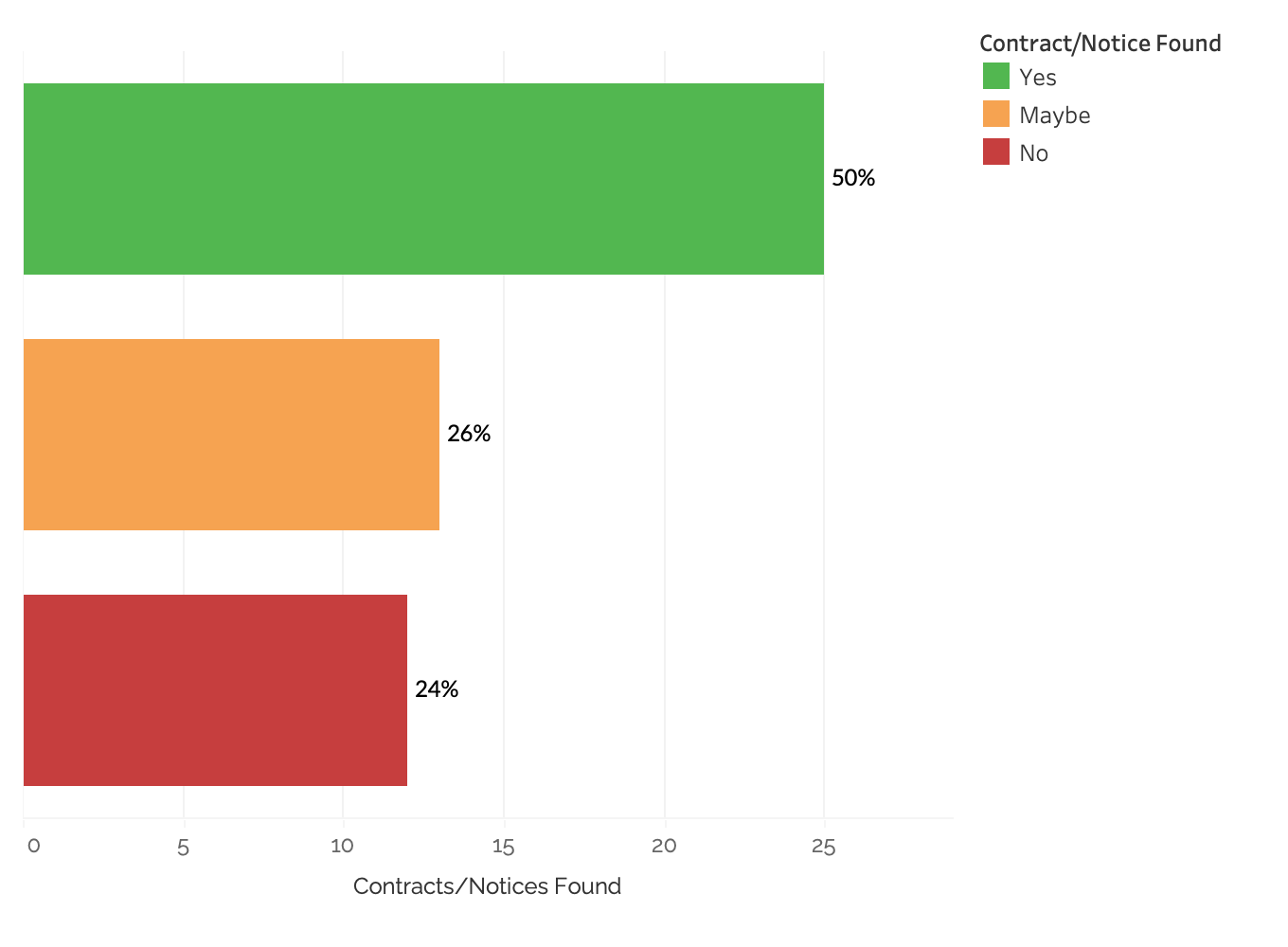

As a result, we applied a simple Red, Amber, Green system for tracking each initiative, which worked as follows:

| GREEN | At least one tender/contract has definitely been published relating to this initiative |

| AMBER | At least one tender/contract has been found that may be linked to this initiative, but it's unclear due to terminology, ambiguity in the pipeline definition, or for some other technical reason |

| RED | No evidence was found of a tender/contract that links to this initiative |

Anecdotal evidence from customers, prospects and partners, as well as our own desktop research, suggests the majority of these initiatives have seen some procurement activity, but our analysis highlights the lack of visibility to the market and the difficulty in reconciling procurement projects with the pipeline.

Overall analysis

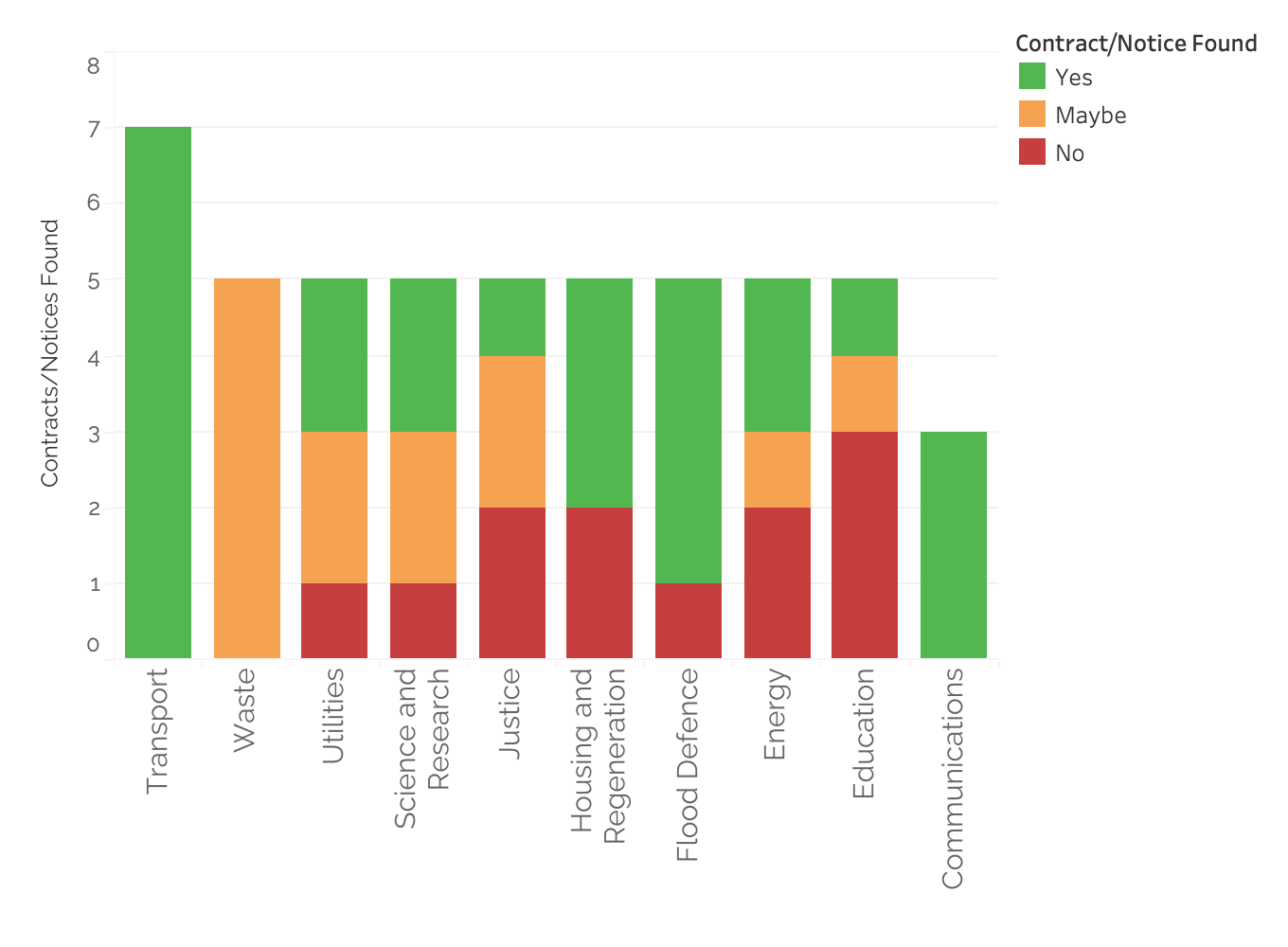

Analysis per sector

There was a huge disparity in published data between sectors. For example, in Transport, procurement linked to the Smart Motorways Alliance was well referenced and a significant amount of activity is visible. By contrast, in Housing and Generation, finding procurement related to programmes like the "Short Term Fund" - for which very little detail is provided in the pipeline - proved unsuccessful.

What are the challenges with using the pipeline?

While the pipeline provides some forward visibility of major projects, we regularly hear from our customers and prospects that it is difficult to put into action - and this stacks up with our own experience.

A small selection of the practical challenges we found were as follows:

- Many initiatives have minimal detail or are extremely ambiguous (e.g. "Long Term Fund") making it hard to find procurement that relates to them.

- Varying terminology on buildings, projects and geography, make it difficult to reconcile initiatives with tenders or contract awards.

- Unforeseen delays to projects like planning and permitting issues can have a significant impact on timelines for projects.

- Due to procurement rules and publishing standards, some sectors publish very little open data.

- It can be difficult to know whether an initiative includes just one procurement activity, several, or even hundreds of individual projects.

- Major tenders conducted under framework agreements are generally not visible via open sources.

Recommendations for future pipelines

By spending every day reviewing public sector procurement data, we have a unique perspective on how these pipelines could be improved.

And they need to be improved. Improving pipelines means better results for everyone and more value for the taxpayer.

It allows suppliers to plan effectively and to have the right resources ready to respond to government priorities. But more importantly, keeping the status quo means suppliers are likely to disregard pipelines altogether - losing faith that they offer any insight or add value to their planning processes.

The Government has recognised this and one of the key policies within the Construction Playbook is to “prepare, maintain and publish comprehensive pipelines of current and future government contracts and commercial activity” which “enables suppliers to understand the likely future demand across government”.

In order to help achieve these aims, our recommendations for improving procurement pipelines are as follows:

- Clearly separate programmes from individual projects.

- Capture unique project/programme codes in notices for tenders and contract awards, which intrinsically link notices to the pipeline.

- Provide a more comprehensive explanation of what each initiative is.

- Offer key words or phrases likely to be used in procurements related to each initiative.

- Ask buyers to use common language when publishing tenders and awards, to ensure consistency on things like project names and geography.

- Provide retrospective reporting on pipeline progress.

- Provide contact details for main lead(s) on each initiative.

How suppliers can make the most of pipelines (despite their shortcomings)

If a particular programme, project, or group of projects, are critical to your business development plans, it's too important to ignore a pipeline like the one published by the IPA - and the same is true for any future pipelines.

With the above in mind, here are our recommendations for getting the most from them:

- Try to reach the project lead using the links provided to learn more.

- Do some further digging on the project or programme to discover relevant phrases, keywords and other important information.

- Monitor new tenders and awards for those items manually, or use a market intelligence platform like Tussell to ensure you're automatically alerted when something is released - book a demo and our team will walk you through this process step-by-step.

- Review previous contract awards and tender notices to discover which buyers are likely to be responsible for the projects and the how they're likely to structure the procurement, so you're fully prepared.

- Search the internet for any of the project references and terms like planning, permissions, etc. to see if the project has been delayed.

Finally, ensure you're looking at the whole market by carrying out in-depth market research. This will provide insight on which buyers are most active, who they're buying from and the status of current projects and programmes - all of which can help you stay ahead of the competition.

If you enjoyed this article and you're interested in more news and analysis on the public sector, sign up to our free newsletter below.

%20v1.png)