Stock market pressure on Kier is mounting. Reports indicate that some of the same hedge funds that anticipated Carillion’s collapse are raising their short positions in Kier.

In advance of the company’s annual results announcement on Thursday, Tussell has crunched the numbers on Kier’s public sector contracts. Based on the fundamentals, we ask: is Kier on the same trajectory as Carillion?

In our opinion Kier emerges positively from this comparison. There are some stark operational differences between the two construction giants that it is worth the market noting.

1. Less revenue concentration

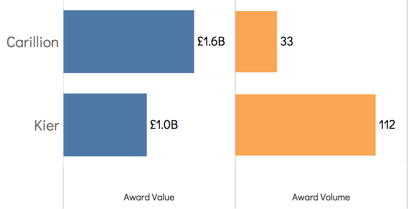

Since the start of 2015, Kier has won 112 public sector contract awards with a reported total lifetime contract value of £1.0Bn. Carillion won £1.6Bn from just 23 contract awards. Kier, in other words, spreads risk among a larger number of smaller contracts - reducing its exposure to dangerous cost overruns on individual projects.

2. Greater customer diversification

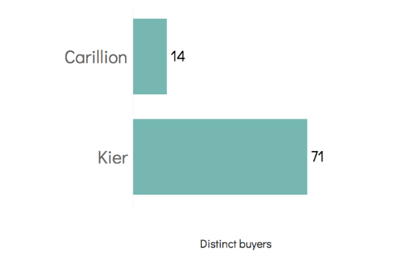

Since 2015 Kier has won contracts from 71 distinct public sector buyers, as compared to 14 for Carillion. Kier, therefore, has significantly less over-reliance on specific public sector buyers and is better able to weather the storm as the impact of austerity on investment ebbs and flows around the public sector.

3. More visibility of future cashflow

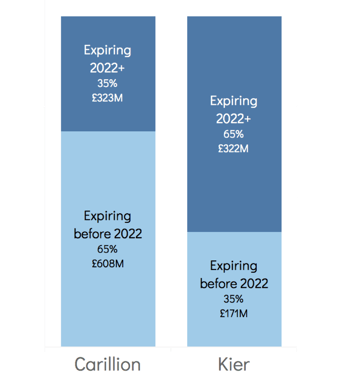

65% of the value of Kier's current awards runs until 2022 or beyond. That means there is good visibility of over two-thirds of the future revenue associated with these contracts.

When Carillion collapsed in January, most of its live contracts were expiring in the short term - one factor driving it to pursue ever more risky, unprofitable contracts merely to fill the gap. Kier is also named on 83 currently active frameworks, giving it plenty of scope to win work off these preferred supplier lists in the future. Carillion was on fewer frameworks and therefore had less buffer.

Kier’s unenviable position in the market’s crossfire means it may or may not fall victim to a downward spiral of investor sentiment. However, based on a fundamental analysis of the portion of Kier’s revenue arising from the UK public sector, our conclusion is that Kier is a far more robust business than Carillion. At a sensitive time like this, it would be dangerous to lump the two businesses together.

Stock market pressure on Kier is mounting. Reports indicate that some of the same hedge funds that anticipated Carillion’s collapse are raising their short positions in Kier.

In advance of the company’s annual results announcement on Thursday, Tussell has crunched the numbers on Kier’s public sector contracts. Based on the fundamentals, we ask: is Kier on the same trajectory as Carillion?

In our opinion, Kier emerges positively from this comparison. There are some stark operational differences between the two construction giants that it is worth the market noting.

%20v1.png)