This article explores what the NHS buys, the benefits of using NHS spend data (alongside tender or contract award data), and how business development professionals can use this public sector information to find and win more NHS contracts.

With the NHS having played such a crucial role in the UK's response to the coronavirus pandemic, interest in public sector NHS services is at an all-time high - and with this, comes increased scrutiny on their spend data.

As the NHS seeks to modernise and improve efficiency, it is increasingly looking to its supply chain to bring innovation to services that improve patient outcomes, which means plenty of tangible business development opportunities for suppliers like you.

Contents

- How much does the NHS spend per year?

- What does the NHS spend on?

- How to find new public sector business opportunities

- How to find new business opportunities using NHS spend data

- Discover who your competitors are doing business with

- Find hidden details in spend descriptions

- Find new partners to enhance your public sector go-to-market strategy

- In conclusion

How much does the NHS spend per year?

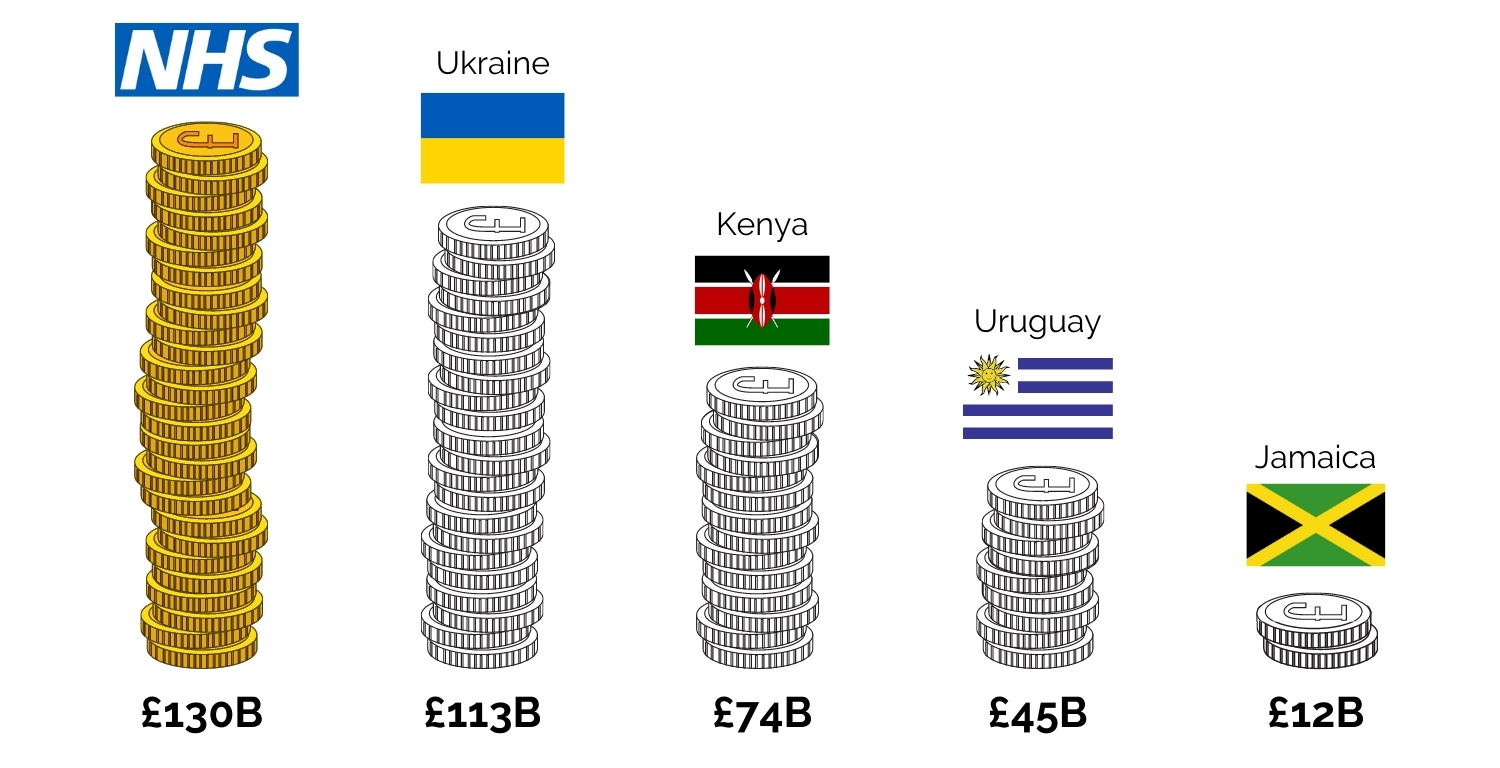

The NHS spends a colossal amount of money each year - £130bn in 2018/2019. To put that into perspective, it's more than the GDP of many countries.

NHS figure 2018/2019 - fullfact.org / GDPs 2019 - statisticstimes.com

NHS figure 2018/2019 - fullfact.org / GDPs 2019 - statisticstimes.com

So, where does the money comes from?

Although NHS organisations can generate some of their own revenue, because it's in the public sector. This means that the vast majority is taxpayers money that flows down from the Department of Health and Social Care (DHSC), to NHS England, then to Clinical Commissioning Groups (CCGs), and finally to NHS Trusts and other organisations to deliver care for patients (please note, this is a simplified summary. If you're interested in a more detailed explanation this King's Fund video is useful, and this page of theirs explains how money flows through the NHS).

What does the NHS spend on?

Although the majority of NHS funds are spent on internal costs, such as wages for more than a million staff, there is still a huge amount spent through the supply chain - both with private sector suppliers and with other public sector organisations.

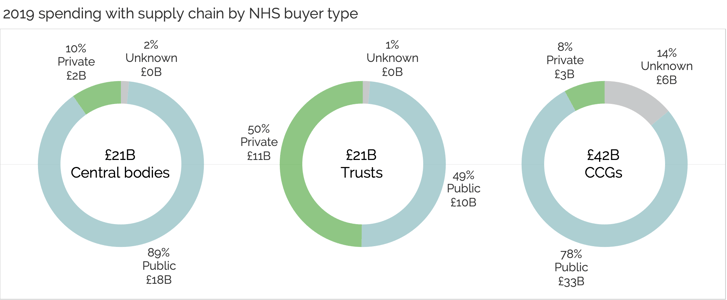

NHS supply chain spend sits predominantly within three main areas:

- Central bodies

- Clinical Commissioning Groups

- Trusts

We can see from the chart above, the vast majority of spending with private sector suppliers is done through NHS Trusts, who spent £11bn in 2019. However, the combined total of £5bn spent with private companies by CCGs and Central Bodies, shows there is still significant opportunities in the other core areas.

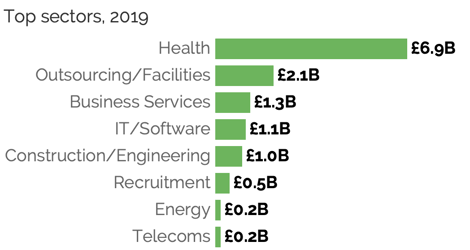

*sector analysis based on supplier nature of business

Perhaps unsurprisingly, the vast majority of spending with private firms sits within the Health sector, although there is also significant spending on Outsourcing/Facilities, Business Services, IT/Software and Construction/Engineering.

|

|

The top 10 suppliers to the NHS by value in 2019 were split between just three categories: Health, Outsourcing/Facilities and Recruitment.

For more detail on spending within NHS Trusts, take a look at our NHS Trust spend summary report.

How to find new public sector business opportunities

Although tenders and contracts are good indicators of commercial activity between the public sector and its suppliers, contract values are typically only estimates.

Spend data, on the other hand, provides transaction-level detail on exactly how much has actually been spent with suppliers, and is, therefore, the best way to 'follow the money'.

Here are just a few of the ways you can use spend data to discover new business development opportunities and increase your pipeline:

Discover who your competitors are doing business with

Contract awards alone do not provide the complete picture of the relationship between a public sector organisation and its suppliers. There are numerous reasons for this, but some of the most common are:

-

The contract is 'under threshold' so does not require formal publication; or

-

The contract is very old and therefore no subject to current transparency rules; or

-

The buyer has not published an award, even though the legislation says they should

Spend data helps you to work around these gaps in the transparency of tenders and contract awards by providing visibility of the transaction-level invoices that are paid by public bodies to their suppliers.

Let's look at an example in more detail.

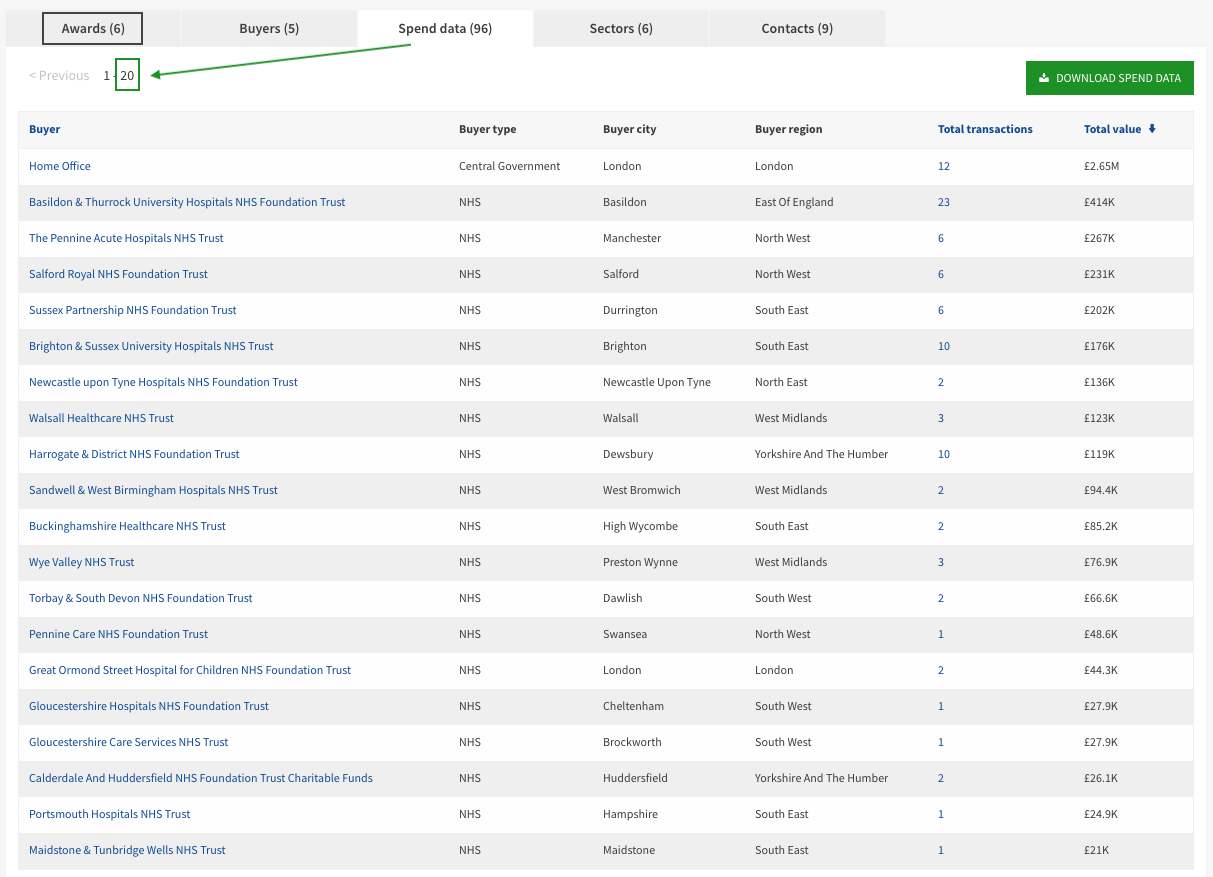

Based on disclosure of contract awards, this unnamed supplier appears to be working with just six public sector bodies; however, spend data reveals 20 existing relationships.

In this example, we can see that the reason in most cases is because the spend figures are relatively low per buyer and per transaction, meaning the publication thresholds for NHS Trusts of £123k (for 2020) have not been reached.

So why is this information helpful? Ultimately, it provides insight into 'hidden' opportunities for NHS contracts. As a business development professional, it allows you to:

-

validate that the buyer has an interest in your services (on the basis they're already buying them from a competitor)

-

use examples of purchases of similar or related services as a means of starting a meaningful and informed conversation with the buyer

-

find buyers that have not bought services like yours before and therefore may be interested in them; and

-

gather intelligence on pricing based on how much public bodies are already spending on services like yours.

Find hidden details in spend descriptions

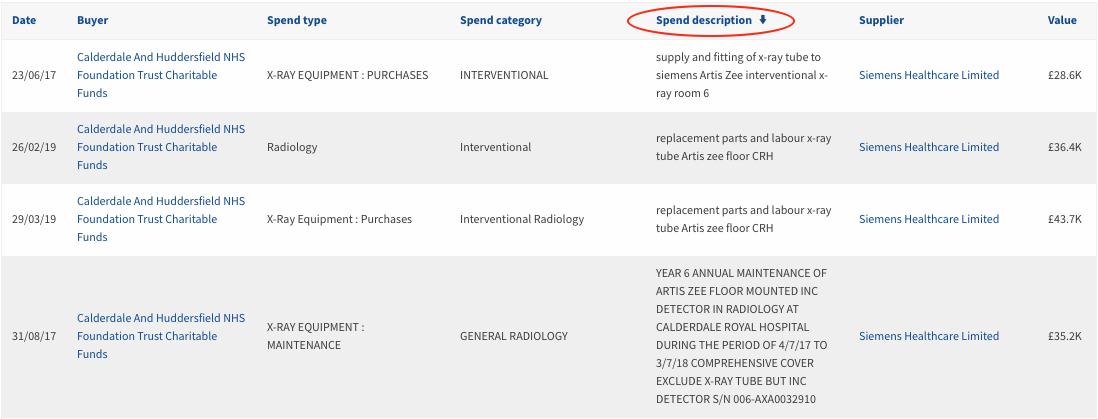

Looking at Spend Descriptions at an individual invoice level can also provide really powerful insights into what's happening between a buyer and a supplier, that goes far beyond the high-level descriptions in contracts.

In the Siemens example above, you can see extra detail relating to replacement parts and maintenance agreements that you simply couldn't find anywhere else. The costs, the frequency, the type of x-ray equipment, even the x-ray room it relates to.

What's the benefit? As a competitor, it allows you to:

-

Start an informed, meaningful conversation, with a decision-maker or technical expert

-

Devise a strategy to offer a different/better service that will help unseat the incumbent

-

Develop pricing that offers better value to the Trust

While the level of information provided in the description varies, in some cases - like the example below - extremely valuable information is disclosed.

Find new partners to enhance your public sector go-to-market strategy

Finding new partners or subcontractors is an essential part of a successful public sector go-to-market strategy for most firms.

Whether it's an introduction to the right person, an opportunity to work with your target account via a partner's existing contract, or you're looking for an experienced supplier for joint bidding, it's essential to find the right companies.

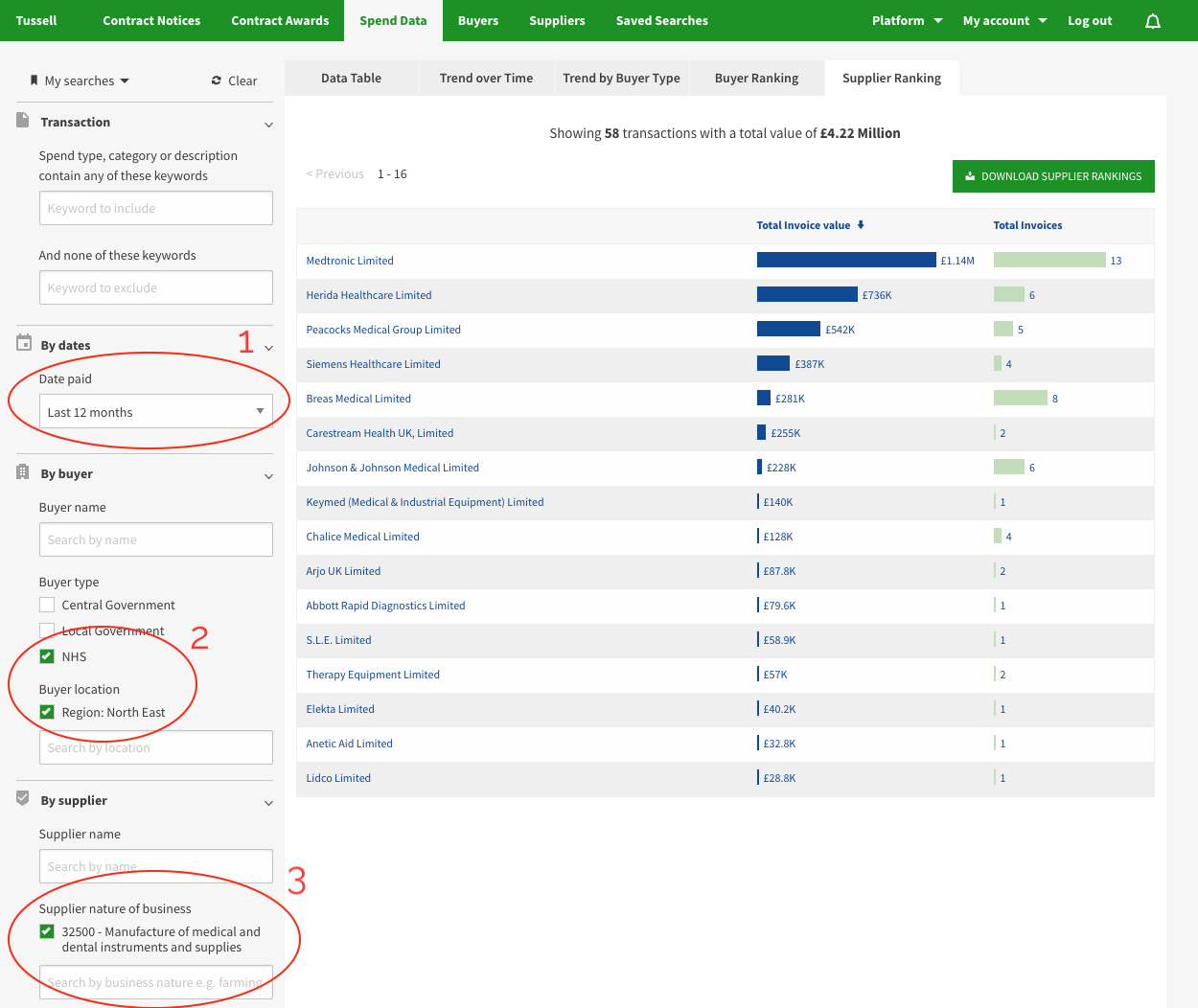

Let's say you were looking for medical equipment suppliers who have access to buyers in the North East of England to partner with and help bring your product/service to market. You can easily conduct a search using the following steps:

-

Select payments in the last 12 months to ensure the relationship is current

-

Select NHS buyers and the region, North East

-

Use Tussell's SIC code / 'supplier nature of business' filter to search for the types of companies you want

In seconds, you have details of the companies you want to speak to, ranked in order of invoice value. In this case there are 16 suppliers, but using multiple 'supplier nature of business' codes can often reveal additional partners.

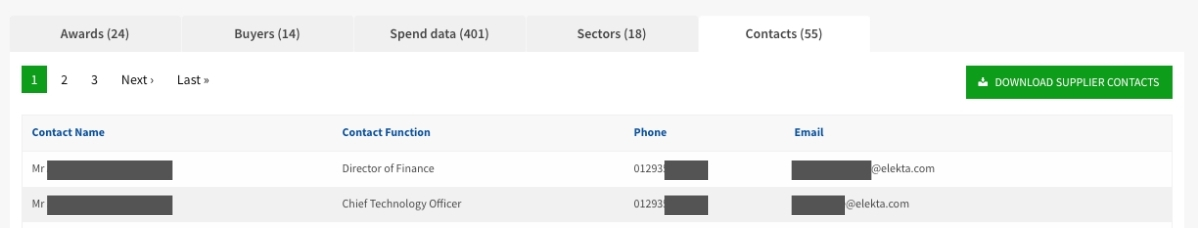

To get in touch with a potential partner, simply click on the company name and you'll be presented with a list of people you can contact, including names, email addresses and telephone numbers.

In Conclusion...

Although selling to the NHS can be complex, using spend data can help you easily find new opportunities and understand existing relationships between buyers and suppliers.

Tenders and contract awards are useful to find the most obvious opportunities, but spend data enables you to be more proactive and strategic with your business development efforts.

We're now seeing spend data used regularly by the UK's most proactive public sector suppliers to increase sales, grow accounts and improve relationships with government buyers.

%20v1.png)

.png?width=1280&height=800&name=Copy%20of%20LinkedIn%20+%20Twitter%20Link%20Posts%201200%20x%20628px%20(4).png)